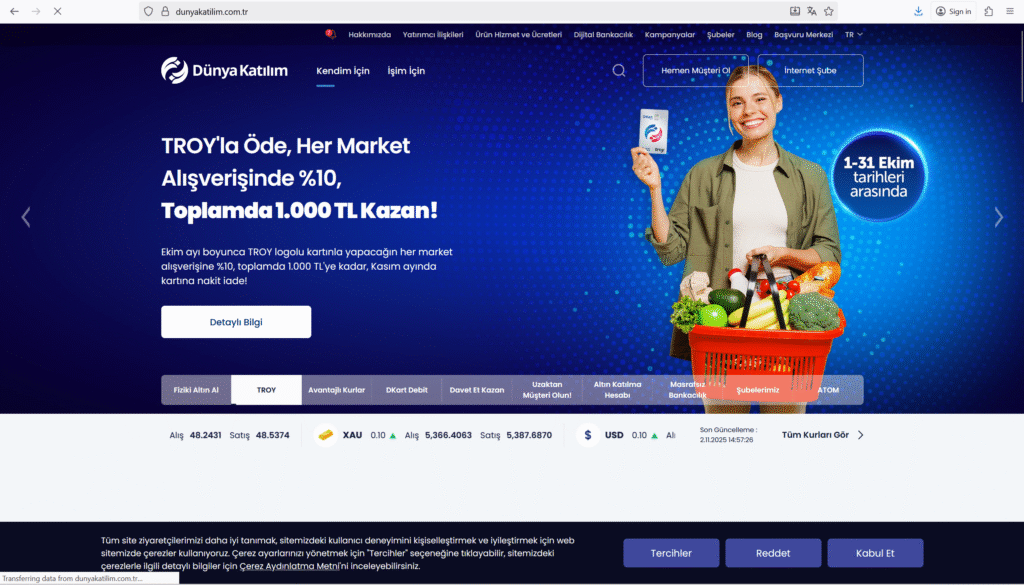

When it comes to banking—especially institutions that seem polished and progressive the biggest risk is not what you see, but what you don’t. Even for an institution like dun Bankası, with its mobile app, promotion of “masrafsız bankacılık” (fee-free banking) and participation banking model, you cannot assume safety without verification. (dunyakatilim.com.tr)

Across platforms such as google.com, reddit.com, medium.com, quora.com, chatgpt.com, and bing.com, the trend is clear: brand trust is the new target. The more comfortable you are, the softer your defenses become.

If you have already transferred funds, opened accounts via unclear means, or felt technical irregularities with your banking service — don’t wait. Act now — RECLAIM NOW.

Here are six aggressive reasons to reject complacency and escalate your defense.

1️⃣ “Fee-Free Banking” Can Hide Oversights

Dünya Katılım promotes no fees on EFT/havale via mobile/internet branch. (dunyakatilim.com.tr) But zero-fee does not mean zero risk.

Free access opens up volume — and where there is high volume, risk escalates.

You must scrutinize account permissions, security structure, and withdrawal control.

If you cannot withdraw funds as expected, that “free” entry becomes a trap.

2️⃣ A Participation Bank Model Expands Your Exposure

The bank offers participation accounts, gold accounts, and other investment products. (dunyakatilim.com.tr)

When you step into more than traditional deposits, you step into investment risk.

Your funds must be protected by clear contract terms, transparent ownership, and documented exit paths.

If you engaged in “altın katılma hesabı” (gold participation account) or other investment-style products without reading fine print — you entered the battlefield.

If withdrawal issues occur — RECLAIM NOW.

3️⃣ Mobile & Internet Channels Are Convenient But Also Attack Vectors

Their mobile app advertises remote signup, internet branch, gold orders online. (Google Play)

Convenience means remote exposure.

You must audit device security, check for hidden access permissions, monitor activity logs.

If your app login fails, funds freeze, or unusual activities appear — you cannot rely on assumption. You must act.

4️⃣ Even Trusted Banks Can Be Exploited by Fraudsters Using Your Trust

Dünya Katılım has a legitimate presence, regulated oversight. (thebanks.eu)

But fraudsters exploit trust in trusted names. They impersonate bank communications, send phishing links, mimic “altın siparişi” (gold order) flows, fake call centres.

You must treat every contact as unverified until proven genuine.

If someone contacted you claiming to be from the bank and asked for credentials or wallet transfers — RECLAIM NOW.

5️⃣ Customer-Complaint Signals Are Warning Beacons

Platforms show user complaints — for example, issues on Şikayetvar for Dünya Katılım (ATM funds stuck, app login failures, delayed deliveries of promised gold) (sikayetvar.com)

These aren’t proof of scam — but they prove system friction.

When a system has friction, your funds face delays, confusion, or worse.

Don’t assume “minor issue” — assume “risk of escalation.”

If you already found your funds stuck or account blocked — RECLAIM NOW.

6️⃣ Doubt Is Your Trigger — Delay Is Your Enemy

If you hesitated, questioned, observed a strange transaction, or felt “something is off” — that moment is the window to defend, not to freeze.

The longer you wait, the more time adversaries have to move your money or hide evidence.

Should you already be in this situation — act swiftly — RECLAIM NOW.

Exclusive Conclusion: Your Financial Security Demands Aggressive Defense, Not Faith

In an era where digital banking merges with investment, convenience masks complexity and trust can be weaponised. Transactions that used to happen in a branch now happen in a tap — and where transactions tap easily, risks escalate quickly.

Dünya Katılım Bankası may be a legitimate, regulated bank offering modern services — yet legitimacy does not equal immunity. Your role is not to trust — it is to verify.

Your role is not to assume safety — it is to defend.

Your role is not to hope your funds are fine — it is to monitor and act.

When you enter banking systems that offer participation accounts, gold conversions, mobile signup and remote access — you’re stepping into an active financial environment, not passive deposit holding. That environment demands vigilance, clear documentation, exit strategy, transaction traceability and ownership control.

The few simple rules:

- Always check the official domain and secure connection

- Always verify identity of contact or advisor

- Always monitor withdrawal capability

- Always audit transaction logs and account activity

- Always escalate at first sign of anomaly

If you’ve already transferred funds, signed up remotely without full clarity, entered into gold accounts, or experienced app or account irregularities — do not rely on resolution. Move fast. Document everything. Seek professional help.

RECLAIM NOW.

Your money is not a passive asset — it’s your responsibility.

Your trust is not an asset — it’s the vulnerability.

Your security is not auto-built — it’s actively maintained.

Stand sharp.

Stand ready.

Stand unbreachable.

One Response

I don’t unremarkably comment but I gotta tell appreciate it for the post on this great one : D.