CedarFX markets itself as a socially conscious, zero-commission broker that promotes sustainable investing, carbon offsets, and “eco accounts.” Beneath those green branding promises, though, lie serious structural, regulatory, and user-risk issues. This article reveals seven blazing warnings behind the CedarFX façade—demonstrating why its “upgrade” narrative should be scrutinized carefully before trusting it with real capital.

1. The Eco-Upgrade Narrative: Green Branding as Distraction

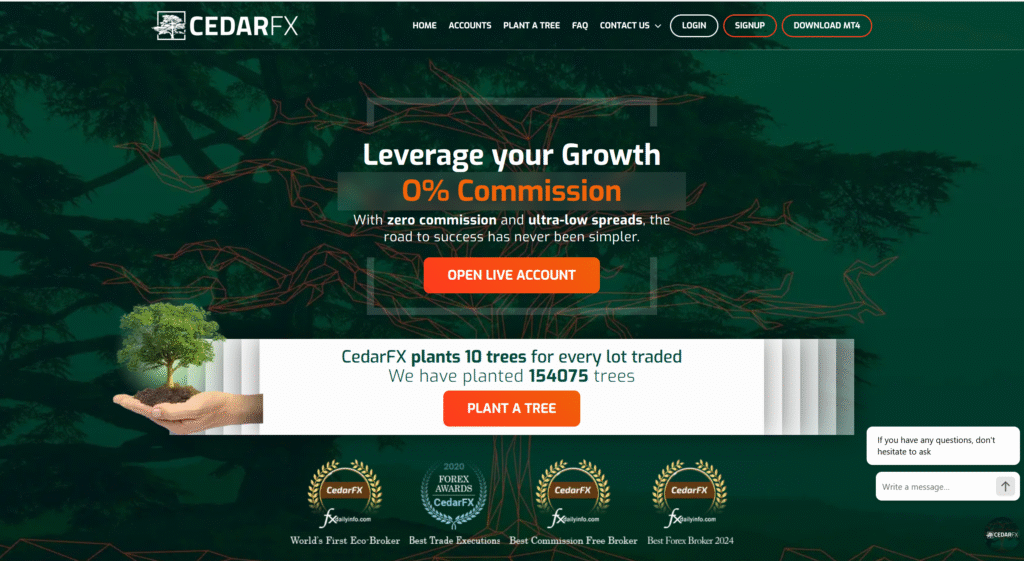

One of CedarFX’s most distinctive marketing angles is its promotion of environmental responsibility. It advertises that every $1 commission in its “Eco Account” is donated to tree planting and carbon offset programs. That branding as an “eco broker” serves to position itself as an upgraded, more moral alternative to typical brokers. But a green veneer does not guarantee financial integrity. When the moral messaging is used to override investor skepticism, it becomes a shield against scrutiny. The focus shifts from “is this broker safe?” to “isn’t this mission noble?” — and that distraction is precisely what powerful branding strategies exploit.

2. Unregulated Status & RED List Flag by U.S. Authorities

CedarFX’s regulatory standing—or lack thereof—is among the clearest red flags. Multiple sources confirm that CedarFX is not regulated by any major financial authority such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). According to WikiFX, it is an offshore broker incorporated in Mauritius but operating without recognized oversight. (WikiFX)

Most significantly, the U.S. Commodity Futures Trading Commission has added CedarFX to its RED List. This designation indicates that CedarFX is acting in a capacity that requires registration in U.S. markets but is not registered. (CFTC RED List) This suggests that U.S. clients who deposit into CedarFX have minimal protections and may face difficulty or impossibility when attempting to recoup losses.

3. Mixed User Sentiment & Withdrawal Complaints

While CedarFX presents a polished user interface and marketing narrative, user feedback paints a more disputed picture. On Trustpilot, reviewers have posted remarks such as:

“They are scammer.. they won’t give proper customer support … deceiving with their website.” (Trustpilot)

Such reports point to challenges in support responsiveness, withdrawal, or transparency. On Reddit forums, users note that CedarFX is headquartered or registered in Saint Vincent & the Grenadines—an offshore jurisdiction with lax oversight—and express concerns about client funds not being segregated. (Reddit)

While some users may praise the low spreads or eco initiatives, reviews that speak to failed or delayed withdrawals require particular attention. A small number of negative reports may be noise, but recurring patterns of withdrawal disruption are classic warning signs.

4. Withdrawals Via Bitcoin Only – Exit Control Risk

CedarFX reportedly allows withdrawals only in Bitcoin (or perhaps crypto) in many cases. This is a red flag of exit control risk. When withdrawals are limited to a cryptocurrency, those pursuing traditional fiat recovery are forced into conversion, which adds friction, variable costs, and time delay. Some user feedback and reviews suggest that fiat withdrawal support is restricted or nonexistent at scale. Because crypto transactions are irreversible and harder to trace once funds leave platforms, this mechanism gives the operator more control over whether and how funds leave. The “upgrade” of allowing crypto withdrawals becomes a constraint rather than freedom.

5. Offshore Structure & Lack of Transparent Ownership

CedarFX is frequently cited as being incorporated offshore—in Mauritius or the Caribbean—and operating from jurisdictions with weaker oversight. (WikiFX, BrokersView) Its ownership structure is not transparently displayed; the identities of its directors or controlling entities are hidden behind corporate shells. Because the broker’s registration and control are opaque, due diligence is obstructed. Investors cannot easily verify where funds are held, whether audits are maintained, or who is responsible when disputes arise. Operating under offshore structure without full regulation makes it easier for a company to deny responsibility or vanish if things go wrong.

6. Low Barrier to Entry, Attractive Terms — a Classic Lure

CedarFX promotes low deposit requirements (e.g. USD 10 or USD 50) and “zero commissions” trading—very appealing terms to new traders. Its marketing also emphasizes minimal fees, tight spreads, and no hidden costs. (Tokenist review) These features function as lures: make entry trivial, reduce friction, attract deposits. However, the more attractive the entry, the more important the exit must be trustworthy. When exit is obstructed or delayed, the easy entry becomes the trap.

7. Imagined Upgrades May Hide Internal Controls

If CedarFX claims upgraded execution, low spreads, and premium features, those promises depend on actual market execution, liquidity providers, and transparent trade handling. But as an unregulated broker, it may operate a B-Book model or internal matching. That means client trades may be held internally rather than routed to open markets. The broker may manipulate fill prices, widen spreads during volatility, or internally reject trades that become too profitable. The “upgrade” experience is conditional—it may work when clients lose, but not when they win. Combined with the withdrawal and exit constraints, that dynamic can turn a broker’s “premium experience” into a selective illusion.

Conclusion: The Façade of Sustainability Masking Risk

CedarFX’s brand as an eco-conscious, zero-commission broker is compelling, especially to socially minded investors. But the heart of financial brokerage is not altruism—it’s accountability. Sustainability claims do not substitute for rigorous oversight, fund protection, or verifiable withdrawal systems.

The CFTC’s placement of CedarFX on its RED List is not a trivial matter. That listing implies U.S. authorities view CedarFX’s activities in U.S. markets as requiring registration—yet CedarFX does not have it. This exposure places U.S. participants in a position of minimal legal protection. Combined with CedarFX’s unregulated status elsewhere, the risk of unrecourse investment is elevated.

User complaints around withdrawal, support delays, or deceptive communication offer real-world echoes of structural weaknesses. While any broker will face occasional user disputes, the recurring theme of obstructed exits must not be dismissed as technical glitch—it may reflect intentional policies of control.

The fact that CedarFX directs withdrawals into crypto only adds another layer of complication for users seeking to recover funds in fiat. The irreversible nature of blockchain transfers and the potential for intermediaries to obfuscate fund flow magnifies exit risk. Crypto withdrawal mechanisms are often used as a final control lever. What seems like freedom may be captivity in transaction form.

Offshore incorporation, opaque ownership, and lack of transparent audits mean that responsibility is diffuse—making enforcement or accountability difficult. If operators use shell entities or rotate domains, investors lose continuity and recourse. The upgrade narrative fails when the operator cannot be reliably traced.

The broker’s low deposit thresholds and attractive conditions are a double-edged sword. While they lower barriers for entry, they also ensure many participants contribute capital before serious verification. Once deposits are active, only a fraction of users may test withdrawals. That is the window in which exit controls can quietly activate. A credible broker may welcome testing of withdrawal mechanisms; a suspect one may engineer delays or failures.

Finally, the claims of premium performance—low spreads, advanced tools—are only meaningful if they apply uniformly. In unregulated models, brokers may skew execution in their favor, degrade service for profitable accounts, or cancel trades flagged as “arbitrage.” The result: clients believe they enjoy upgrades until the moment they profit—then those benefits vanish.

For anyone considering using CedarFX, insist on full transparency before depositing. Ask for proof: real withdrawal logs, external audits, regulatory registration in recognized jurisdictions, client fund segregation, and history of performance over time. If any link is weak or missing, treat the platform as high risk.

If deposits are already made, act without delay. Attempt small test withdrawals, preserve all records (screenshots, emails, transaction IDs), and file complaints with your regulators. Engage crypto asset trackers if funds were withdrawn or transferred. Be aware that time matters—scam operators may move funds quickly between wallets to evade tracing.

CedarFX may present an upgrade in branding and ethos, but the true test of any broker is whether you can retrieve your profits, not how beautifully the interface displays them. When execution becomes constrained, exit becomes obstructed, and oversight is absent, the “upgrade” becomes an illusion. Always favor transparency over appeal—especially when sustainability is used to mask structural risk.