CloseOption presents itself as a straightforward, beginner-friendly binary options broker. With low minimum deposit requirements, crypto funding, and a web-based platform called “TradeRoom,” it’s easy to see why many new traders are drawn to it. However, beneath that façade, many serious red flags suggest that CloseOption carries high risk, lacks credible regulation, and may operate closer to a scam than a legitimate broker. Below is a hard-hitting analysis of the dangers, patterns, and concerns every trader should know.

1. Regulation Claims That Don’t Hold Water

CloseOption says it is registered in Georgia and licensed via the National Bank of Georgia (license B2-08/3647). Several review sites repeat that claim. (Source: DayTrading) But that “regulation” is weak in practice: Georgia does not have robust oversight mechanisms for binary options and foreign exchange.

BrokersView explicitly labels CloseOption a scam, stating that although it claims Georgian licensing, Georgia has no real rules regulating forex or binary options trading, making those claims meaningless. (Source: BrokersView)

So when you hear “licensed by Georgia,” consider it marketing, not protection. Without oversight by a trusted body (FCA, ASIC, CySEC, etc.), you have little recourse if the broker turns hostile.

2. Mixed User Trust & Delayed Withdrawals

On Trustpilot, CloseOption holds a moderate rating (around 3.8/5), with some users praising smooth withdrawals, prompt support, and clean deposits. (Source: Trustpilot)

But deeper into the reviews, you’ll find reports that withdrawals of large sums were refused or delayed. One user reportedly requested $6,500 and was told CloseOption lacked liquidity to pay it all at once. (Source: Trustpilot)

On FX-List, a veteran user claims that after months of trading, upon withdrawal request, their account was locked and service vanished. (Source: FX-List)

This difference—small withdrawals granted, large ones stalled—is a classic broker risk behavior.

3. Platform Limitations & Lack of Advanced Tools

CloseOption uses a proprietary web interface (TradeRoom). It offers simplicity over sophistication. (Source: BinaryTrading)

However, it does not offer MetaTrader 4, algorithmic trading, or advanced order tools. Its charting features are basic and limited in depth. (Source: BinaryTrading)

For serious traders accustomed to automated strategies or advanced charting, these limitations can be fatal. If your trades rely on logic or automation, you’re largely trusting their engine — which may have built-in biases.

4. Deposit Bonuses & Conditions That Might Trap Funds

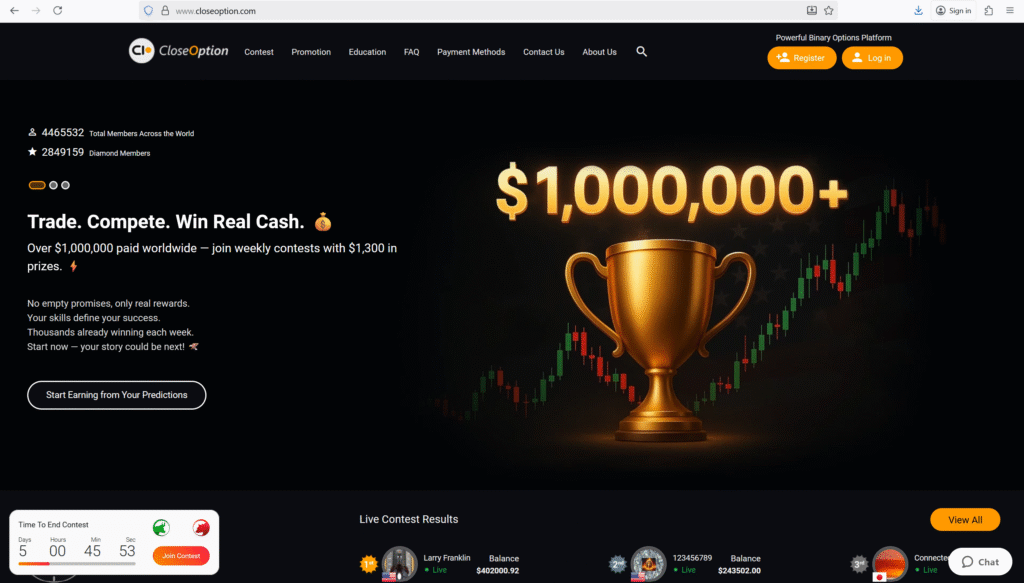

CloseOption runs promotional offers: welcome gifts, deposit bonuses, weekly contests. (Source: DayTrading)

The danger: bonuses often carry volume or trading conditions before funds or profits can be withdrawn. If you fail to meet those hidden conditions, the broker may refuse to release your money or nullify your profits.

Many users in review forums allege that after accepting such bonuses, withdrawals became blocked or demanded extra trades. Combined with unverified regulation, that should alarm cautious traders.

5. Toxic Exposure from BrokersView & Scam Watchers

Among broker review sites, CloseOption is singled out. BrokersView’s assessment states clearly: “Based on its regulatory status, CloseOption is a scam.” (Source: BrokersView)

Their logic: the broker claims Georgian licensing, but Georgia lacks enforceable regulation of forex or binary options. Meanwhile, client funds are unprotected.

When an independent broker analysis site labels it “SCAM,” that is not minor noise — it’s a serious warning.

6. Public Complaints of Account Blocking & Hacking Claims

WikiFX profiles several complaints: one user reports their account was hacked, funds drained, and support silent. (Source: WikiFX)

Another reports account locking after verification requests, followed by broken withdrawal attempts. (Source: WikiFX)

While individual reports can be exaggerated, the pattern — accounts disabled when funds rise — aligns with fraud behaviors.

7. Exit Strategy: Vanishing and Rebranding Risk

CloseOption’s business structure suggests an easy exit. With offshore registration, anonymous ownership, and weak regulatory claims, a sudden domain takedown or rebrand could leave most clients stranded with no legal recourse.

Brokers in this space often operate for months or years, collecting funds, then disappear or shift to a “new version” under a slightly changed name. Given CloseOption’s vulnerabilities, that scenario is credible.

Conclusion — CloseOption’s Risk Demands You Assume the Worst

CloseOption may appear benign: low deposit, user-friendly interface, crypto options, and promotional contests. But underneath, it is riddled with structural risk:

- Its regulatory claims are weak cover, lacking real protection

- Withdrawal behavior shows signs of stalling or freezing when larger amounts are involved

- Its platform is basic and gives you little control or proof of fairness

- Bonus schemes may act as traps, not incentives

- Watchdog sites plainly call it a scam based on license mismatch

- Numerous user complaints point to blocked accounts and hacking claims

- Its architecture allows vanishing or rebrand without accountability

If you have funds in CloseOption, treat them as endangered. Begin your crypto reclaim mission immediately:

- Document every transaction, screenshot, email, and KYC exchange

- Attempt a withdrawal test with a modest amount

- File formal complaints with your local regulator, consumer protection, and cybercrime units

- Expose your story on trading forums, review sites, and complaint boards

- Do not send more funds under “bonus unlock” or “verification fee” claims

In the world of binary brokers, your real test is whether you can exit — not enter. CloseOption fails that test in many real accounts. Unless you see consistent, successful withdrawals from diverse users and verified regulation, consider it unsafe and act defensively.