Introduction

The rise of financial technology platforms that promise sustainability integration has created both hope and anxiety in the investment world. One of the latest examples is GreenLedgers, an online portal presenting itself as a gateway to environmentally conscious financial tracking and corporate accountability. At first glance, the brand name evokes trust: “green” for sustainability and “ledgers” for accountability. Yet beneath the surface lies a more troubling story. Websites like Green Ledgers have begun to appear with growing frequency, often promising to combine financial transparency with ecological responsibility, but frequently offering neither.

This article dissects the case of Green Ledgers through seven revealing truths. It applies a structured lens to understand how such sites operate, what dangers they pose, and why individuals and corporations alike must tread carefully. The goal is not merely to expose a questionable platform, but also to guide readers on how to distinguish between genuine green-fintech innovation and cleverly branded schemes.

1. The Promise of Sustainability Masking the Reality of Profit

At its core, Green Ledgers attempts to capitalize on the booming market for environmental, social, and governance (ESG) investments. Global funds managing trillions are under pressure to allocate capital toward sustainable ventures. A platform calling itself “Green Ledgers” naturally positions itself at the intersection of finance and ecology.

But the rhetoric of sustainability is often easier than its implementation. Many suspicious ventures frame their offerings in “green” language while providing no verifiable evidence that funds, data, or projects are genuinely tied to climate-positive outcomes. Without transparent documentation, certifications, or verifiable reporting structures, sustainability becomes a marketing slogan rather than an operational standard.

2. Lack of Transparency in Operations

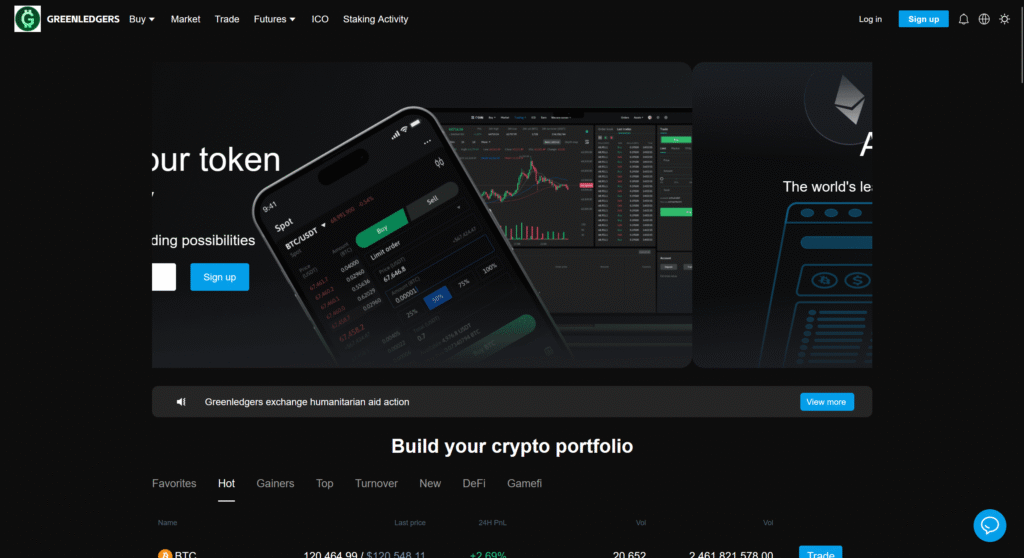

The most glaring issue with Green Ledgers is its opacity. When users attempt to access the website, they encounter barriers requiring JavaScript activation without delivering actual content. This is more than a technical quirk — it raises immediate concerns about the company’s legitimacy.

Legitimate fintech and ESG reporting platforms typically showcase case studies, team credentials, investor guidelines, and compliance certifications. By contrast, Green Ledgers provides nothing accessible at face value. In the world of financial compliance, opacity is not a neutral inconvenience; it is a red flag.

3. Exploiting the Green Finance Narrative

The timing of platforms like Green Ledgers is telling. With rising government regulations on carbon disclosure, corporate sustainability reports, and climate-linked investments, investors are eager for tools that simplify ESG integration. Fraudulent or poorly structured companies know this and exploit the trend.

By presenting themselves as “green finance pioneers,” such platforms lure investors who want both moral satisfaction and financial return. But in the absence of audited financials, verifiable ESG metrics, and secure technology, the risk of financial loss grows.

4. Risks of Data Manipulation and Greenwashing

If Green Ledgers were genuinely offering environmental accounting tools, one would expect clear methodologies for measuring carbon output, water usage, or other sustainability metrics. Instead, there is silence.

This vacuum opens the door to greenwashing — when companies or platforms exaggerate or falsify their sustainability credentials. By claiming to integrate environmental metrics into financial ledgers without independent oversight, the platform could mislead both investors and corporations.

This is not just unethical but dangerous: investors may unknowingly allocate funds into unsustainable practices, undermining both profit and planet.

5. No Clear Ownership or Regulatory Footprint

Perhaps the most alarming factor is the absence of publicly available details about Green Ledgers’ ownership, regulatory compliance, or licensing. In the fintech and ESG sectors, regulatory oversight is not optional — it is mandatory.

- Who founded Green Ledgers?

- What jurisdiction licenses it?

- What safeguards protect users’ financial data?

- Which independent auditor reviews its environmental claims?

Without answers, the platform cannot be trusted. Unregistered operations in the finance sector have historically resulted in catastrophic losses for unsuspecting users.

6. Investor and Corporate Risks

The risks of engaging with platforms like Green Ledgers are not limited to investors. Corporations that integrate unverified sustainability tools into their reporting risk damaging their reputations, violating regulatory standards, and facing legal consequences.

Imagine a multinational firm presenting data from Green Ledgers in its ESG disclosures, only for regulators to later determine that the numbers were unaudited or fabricated. The reputational, legal, and financial costs would be immense. Thus, the risk runs downstream: from individuals to corporations to entire industries.

7. Safer Alternatives Exist

The most important truth is that safer, proven alternatives exist. Numerous licensed platforms, backed by reputable auditing firms and regulatory approvals, already provide sustainability integration. Investors and businesses should gravitate toward those instead of experimenting with opaque ventures like Green Ledgers.

In fact, the rise of fraudulent “green” platforms should reinforce the importance of vetting companies carefully. Due diligence, independent verification, and regulatory oversight are the only shields against financial loss and reputational harm.

Conclusion:

The story of Green Ledgers is not unique, but it is emblematic of a larger pattern unfolding across financial markets. As sustainability becomes a global priority, opportunistic actors see an opening to exploit investors’ desire to do good while making money. They attach the language of environmentalism to financial tools, creating a veneer of legitimacy. Yet beneath the branding lies a hollow structure, often devoid of transparency, accountability, or regulation.

Green Ledgers demonstrates how branding can outpace reality. A website carrying such a promising name should, in theory, embody the very principles of transparency, responsibility, and integrity. Instead, it offers little more than a placeholder page, with no substance behind its facade. This contradiction should concern every investor, corporate executive, and policymaker.

The risks extend far beyond financial loss. If investors pour capital into unverified or fraudulent “green” platforms, real sustainable initiatives lose resources. If corporations rely on unproven reporting tools, their ESG disclosures lose credibility, eroding public trust in sustainability altogether. And if regulators cannot keep pace with such entities, entire markets become vulnerable to greenwashing at scale.

To counter these risks, stakeholders must adopt a multi-layered defense. First, individual investors must exercise skepticism. Promises of sustainability should never replace proof. Verified certifications, independent audits, and transparent ownership structures must be the baseline standard.

Second, corporations must strengthen their ESG due diligence. Before partnering with platforms, they should demand technical demonstrations, regulatory documentation, and independent verification of environmental claims. Only then can they ensure that their sustainability reporting aligns with both reality and regulatory standards.

Third, regulators and international agencies must close the loopholes that allow such entities to thrive. Just as anti-money laundering compliance evolved to catch global financial fraud, sustainability reporting standards must evolve to detect and punish fraudulent ESG claims. Here, international collaboration is critical — a single rogue platform can erode trust across borders.

Finally, the public must recognize the dual edge of innovation. Fintech and sustainability integration hold immense potential for reshaping global markets in positive ways. But innovation without oversight breeds exploitation. For every genuine platform striving to make sustainability measurable and accountable, there will be imitators like Green Ledgers using the rhetoric of responsibility without the substance.

In the end, the case of Green Ledgers is a cautionary tale. It reminds us that trust in finance and sustainability must always be earned, not assumed. True accountability is not a matter of branding but of verifiable practice. By staying vigilant, demanding transparency, and supporting only those platforms that prove their legitimacy, we can ensure that sustainable finance fulfills its promise — driving both profit and planet toward a better future.