Introduction

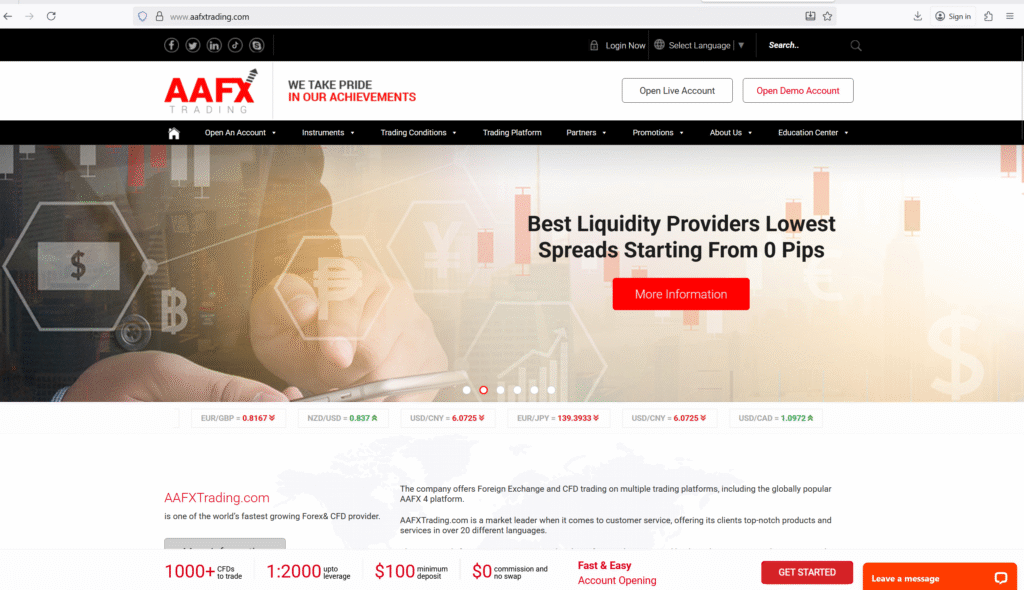

Dear Reader, if you’ve encountered the website aafxtrading.com or are being pitched “AAAFX Trading” as your next big broker you must hit pause and dig deeper. There are significant warning signs: regulatory alerts, mixed review records, and conflicting claims of licensing. For example, the U.S. Commodity Futures Trading Commission (CFTC) has added AAFX Trading to its Red List because it “appears to be operating in a capacity that requires registration but isn’t registered.” (CFTC)

This Element 2 article presents 8 critical alerts to explain why you may need to shift into AAAFX Trading scam recovery mode — involving chargeback crypto scam, recover stolen cryptocurrency, crypto fund recovery services, blockchain tracing investigation, and report crypto fraud efforts. Check resources like google.com, threads on reddit.com, discussion at chatgpt.com, articles on medium.com, Q&A on quora.com, or search via bing.com for wider context.

➡️ RECLAIM NOW

1) Regulatory Red Flags — CFTC & SFC warnings

The CFTC lists AAFX Trading as unregistered despite offering services that appear to require registration. (CFTC) Additionally, the Hong Kong Securities and Futures Commission (SFC) has placed warning notices regarding the brand. (BrokersView)

If a broker lacks legitimate regulation, you have no formal investor protection, no recognised complaint channel, and you may face very limited recovery options.

2) Conflicting claims vs legal reality

While the brand “AAAFX Trading” may carry legitimacy in certain branches, the domain you’re dealing with (aafxtrading.com) is flagged by multiple watchdogs as an unlicensed and high-risk broker. (BrokersView)

When you see conflicting statements about regulation, approach extremely cautiously — you may be dealing with a clone or unregulated version of a legitimate branch.

➡️ RECLAIM NOW

3) Mixed review footprint — some positive, many warning-laden

On Trustpilot the provider lists over 140 reviews under AAFX Trading with many complaints of large losses, withdrawal refusals, and pressure from account managers. (Trustpilot)

Yet other review platforms show this broker as regulated and stable. Discrepancies like this often emerge when a broker uses multiple jurisdictions or brand variants — which significantly increases recovery complexity.

4) High-leverage offers and exotic bonus conditions

Research indicates that domains like AAFX Trading offer extremely high leverage (sometimes 1:2000) and generous “bonuses” designed to draw large deposits. (BrokersView)

These conditions often work to funnel funds fast—and the moment you request withdrawal, you encounter bonus-related restrictions or account locking. That’s when you shift into recovery mode.

5) Withdrawal issues and escalation of risk

Multiple complaints cite scenarios where the broker changed terms post-deposit, slowed withdrawal processing, or refused payments citing unverifiable reasons. For example: “We were told the bonus conditions were complete, but the funds still won’t withdraw.” (Medium)

Once withdrawal is blocked, you’re not trading—you’re chasing funds.

➡️ RECLAIM NOW

6) Domain/brand confusion = recovery nightmare

The brand “AAAFX” appears in different jurisdictions (Greece-regulated, South-Africa regulated), while the domain you don’t know (aafxtrading.com) may be an unlicensed clone. Sites such as WikiBIT note differing status for AAFX International. (Wikibit Forex)

When recovery time comes, the correct entity may be hidden behind layers of brand variants — making legal claims and tracing funds far harder.

7) If you’ve already deposited — your next move is recovery

If funds are already with this broker, stop further deposits immediately. Shift your focus:

- Document every transaction, communication, TXID (if crypto)

- Contact your bank/payment provider: ask about chargeback crypto scam or disputed payment avenues

- If crypto was used, engage blockchain tracing investigation to trace the destination of your funds

- Report to regulator in your country and post your story on reddit.com, quora.com and medium.com — sharing details strengthens collective recovery potential

➡️ RECLAIM NOW

8) If you haven’t deposited yet — walk away now

Before funding any account, do this:

- Search domain via google.com and bing.com for withdrawal complaints or regulatory warnings

- Verify exactly which legal entity you’re dealing with — is it the regulated Greek AAFX or an offshore version?

- Search for withdrawal proofs from real users (not paid testimonials) on reddit.com and quora.com

If you fail any of these tests, your capital isn’t trading — it’s being prepped for recovery.

➡️ RECLAIM NOW

Exclusive Conclusion

The truth is stark: AAAFX Trading (aafxtrading.com) may look polished, but it shows all the signs of a high-risk scenario instead of a regulated investment opportunity. Unauthorised jurisdictions, regulatory warnings, domain confusion, bonus offers tied to high leverage, and countless withdrawal complaints all point to a system built for deposits rather than protection. You’re not just trading—you’re entering the danger zone where the next stage is fund recovery.

If you haven’t deposited yet — thank yourself for caution. Walk away. Your capital deserves platforms with verified licences, transparent owners, audit trails, and proven withdrawal history. If you’ve deposited — act now. Stop further funding, collate all evidence, contact your financial institution, initiate chain tracing (if crypto), file complaints, and share your experience publicly. The sooner you move, the better your recovery odds.

Don’t let slick marketing or high-promise leverage fool you. Your money deserves transparency, legitimate oversight, and real recourse. If those aren’t present you’re not trading, you’re entering recovery mode. Stay sharp. Move decisively. Reclaim control.