Before you even think about depositing money or trading with LuminexFinance.com, you need to stop and analyze the facts. This report breaks down why this platform raises significant warning signs, why your capital could be at risk, and why you should not trade or invest here without verified oversight.

A Smart First Step: Verify Before You Trust

Before trusting any broker, use Google to search official license records. Genuine regulation is always verifiable through official regulator databases; screenshots on a website are not enough.

1) Unclear or Missing Authorization Is the Biggest Red Flag

Independent broker-review research reports that Luminex Finance holds no valid license and that claims of regulation including alleged FCA oversight appear fabricated, with no matching results found in public regulator registries such as the NFA.

If a broker can’t be verified through official authorities, your deposit could be at risk with no legal safety net.

2) Very New Domain Adds to Risk When Paired With Big Promises

Domain intelligence shows the site luminexfinance.com was registered on September 30, 2024.

Domains this new typically lack a proven track record, and when they make bold claims without verification, this increases the risk that they could disappear or rebrand quickly.

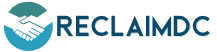

3) Wide Product Menu Without Clear Compliance

The platform advertises a broad suite of offerings including forex, stocks, oil, and more.

While variety can be attractive, unregulated brokers often use wide menus to appeal to as many victims as possible. Without regulatory oversight, there is no assurance these products are legitimately offered.

4) Marketing Language ≠ Regulation

Terms like “secure,” “innovative,” and “tailored solutions” are simply marketing phrases. Real investor protection comes from:

- A clear legal entity

- A valid regulator license covering retail clients

- Segregated client funds

- Audited financials

Without these, you have no structured road map for dispute resolution or withdrawal enforcement.

5) High-Pressure Sales Tactics Signal Danger

Watch for “account managers” who push deposits with urgency. High-pressure language like “limited opportunities” or “unlock superior returns now” is not how reputable brokers communicate.

Bad actors use urgency to get you to deposit before you realize what protections you lack.

6) Withdrawal Friction Is Where Most Victims Get Trapped

One of the most common signals of a risky broker is withdrawal obstruction. Delays, extra verification demands, unexplained fees, or sudden requirements to send additional funds before you get your money back these are all red flags.

When victims run into these issues, they often start searching forums for forex recovery help afterward. If you encounter any barriers to withdrawing your capital, treat them as immediate danger signs.

7) Fake Dashboards Create “Profit Mirages”

Unlicensed platforms can display any numbers they choose on internal dashboards. Profits shown there may not reflect real market execution — they may just be a tactic to keep you depositing more.

Before trusting performance claims, look for real third-party confirmation of execution reports.

8) If You’ve Already Sent Money, Act Fast

Stop sending further funds. Secure all evidence:

- Deposit receipts

- Chat transcripts

- Email logs

- Screenshots of account statements

If you deposited by card or bank transfer, contact your provider immediately about dispute options before time limits expire. If you used crypto, record wallet addresses, transaction hashes, and exchange details. This information is essential for investment scam recovery, crypto recovery, and crypto reclaim cases.

Conclusion — Protect Your Capital Before It’s Too Late

LuminexFinance.com presents multiple warning flags that must inform your investment decisions:

- No verifiable regulation — regulators don’t recognize its claims.

- Very new domain — minimal history means uncertain credibility.

- Wide product menu without transparency — risky without oversight.

- Withdrawal barriers are a common danger — protect your funds now.

When a broker’s credentials are unclear, assume your money is unprotected and your withdrawal rights are negotiable rather than enforceable. In regulated markets, compliance is essential — and verification comes from official databases, not a slick homepage.

If you’re researching broker legitimacy, here are tools that can help:

- Watch independent break-downs on YouTube

- Read analysis and reports on Medium

- Use AI due-diligence support from ChatGPT

- Browse community discussions on Quora

- Treat short clips cautiously they may be marketing on TikTok

- Search broader references and warnings on Bing

Your safest investment move is the one you make before sending any funds to a broker you haven’t independently verified. Protect your capital, verify first, trade later.