Be Cautious With Liquidbrokers.com

Before you deposit money or trade with Liquidbrokers.com, take a moment to understand the risks involved. While the site markets itself as an online trading broker with global markets access, there are significant transparency, regulatory, and user-feedback concerns that investors should carefully weigh before proceeding. This investor alert highlights why caution or avoidance may be the safer choice for your capital.

1. Regulatory Claims Are Unclear and Possibly Out of Scope

Liquid Brokers states it operates through Liquid Markets Pty Ltd as a Corporate Authorised Representative of Pulse Markets Pty Ltd, which holds an Australian Financial Services License (AFSL). (liquidbrokers.com)

However:

- Pulse Markets’ AFSL may only permit services to wholesale clients, not retail traders. (FastBull)

- ASIC (the Australian Securities and Investments Commission) does not list the site’s trading name or website directly, making independent verification difficult. (FastBull)

This mismatch suggests that if you are a retail investor, the services you’re offered might not be fully authorized under Australian regulatory standards — meaning your funds might lack solid legal protection.

2. Trust and Safety Indicators Raise Questions

Automated site-trust tools warn that liquidbrokers.com has a low trust score, flagging it as potentially high risk based on multiple data points such as domain indicators and financial service signals. (ScamAdviser)

Low trust scores can indicate anything from questionable business practices to lack of transparency, and should not be dismissed without deeper due diligence.

3. Mixed or Poor Public Feedback

User reviews on sites like Trustpilot show mixed to negative experiences, with a TrustScore around 2.4 / 5 and multiple traders reporting issues. (Trustpilot)

Common themes in negative feedback include:

- Requests for additional deposits before withdrawal processing

- Losses blamed on platform operations

- Technical execution issues

While some users report positive outcomes, the divide in experiences suggests there may be inconsistent service or reliability issues.

4. Independent Scam Analysis Has Criticized the Broker

Some independent sources — including video investigations — claim that Liquid Brokers may not be as regulated or transparent as advertised, and caution that traders perform their own research before investing. (YouTube)

These kinds of independent analyses are not formal regulatory judgments, but they often highlight information asymmetry that mainstream disclosures omit.

5. Regulatory Verification Must Be Verified Independently

Your safest approach is to double-check broker details yourself using independent regulator databases and research tools such as Google or official government registries.

Even if a broker claims a corporate license, it’s critical to confirm whether:

- The license covers the specific products you want to trade

- The license covers retail clients

- The broker’s operating entity matches the regulator’s records

Without this clarity, your funds may lack proper oversight.

6. User Discussion Reflects Platform Concerns

Conversations among traders on community forums like Reddit sometimes reflect mixed opinions about brokers like Liquid Brokers, particularly regarding execution quality and platform user experience. (Reddit)

Forums can be valuable because they often capture real-world experiences, including technical and service issues that formal reviews may miss.

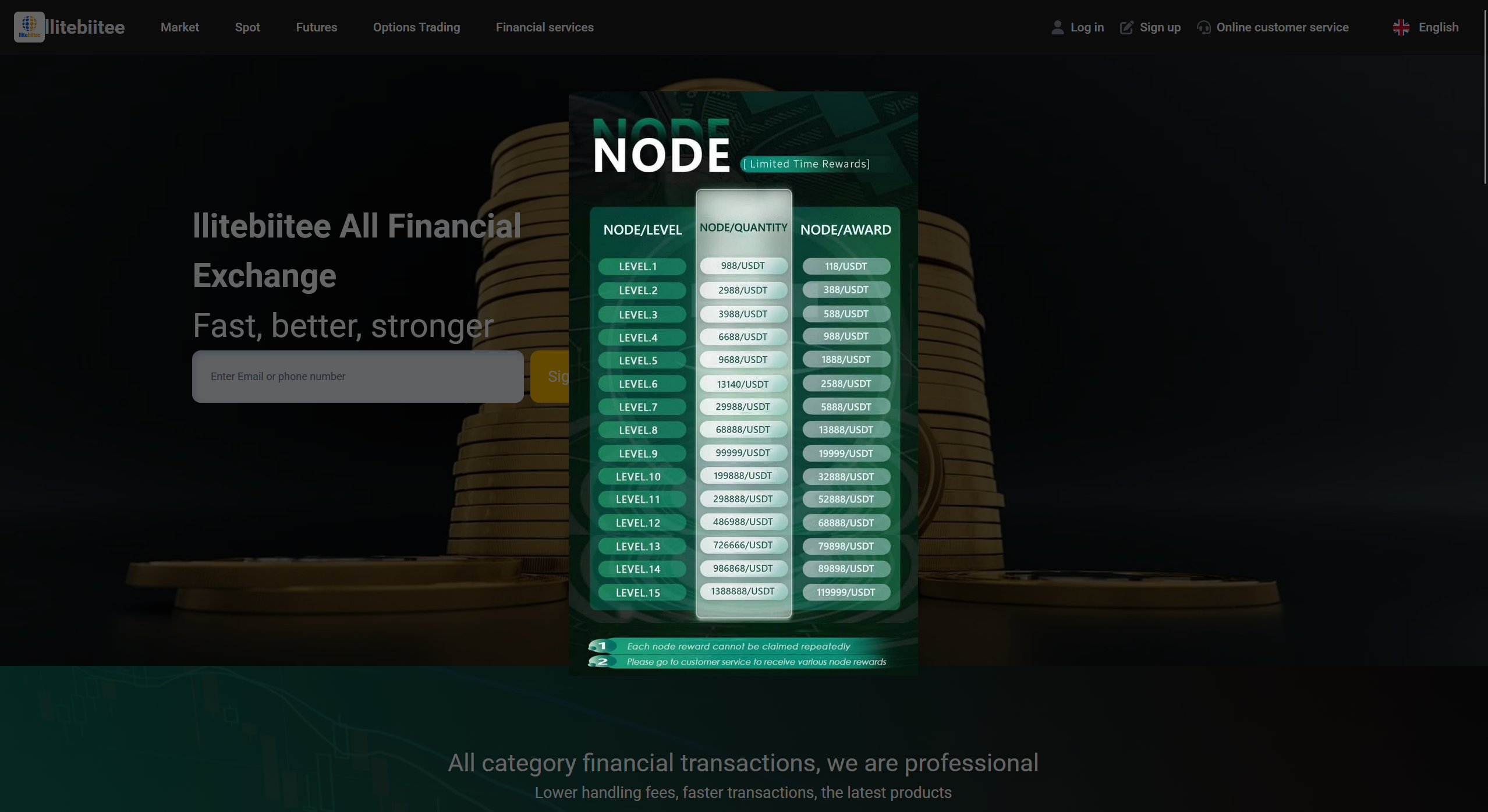

7. High-Risk Products Demand Higher Scrutiny

Liquid Brokers markets a range of trading instruments — including forex, crypto, stocks, and commodities — accessible via its proprietary “Liquid Charts” platform. (liquidbrokers.com)

Trading leveraged products such as forex and CFDs carries significant risk, and regulation exists to protect traders from certain abuses. If a broker’s licensing status is unclear or limited, that protective layer may not apply, increasing the risk of loss or platform disputes.

8. Independent Videos and Reviewers Advise Due Diligence

Multiple independent video reviewers have published content advising traders to approach Liquid Brokers with caution, pointing out weak regulation clarity and possible operational concerns. (YouTube)

While video content is informational and not a regulatory ruling, these discussions highlight the importance of thorough verification before trading.

Conclusion: Proceed With Caution,Or Consider Alternative Brokers

Here’s a concise summary of why you should carefully evaluate your decision before trading with LiquidBrokers.com:

❌ Regulatory Ambiguity

The licensing structure may not cover retail investors — meaning no guaranteed protections if disputes arise. (FastBull)

❌ Trust Signals Raise Concerns

Automated safety tools flag the site with a low trust score. (ScamAdviser)

❌ Mixed User Feedback

Both positive and negative experiences exist — but several reported issues with withdrawals and platform behavior warrant attention. (Trustpilot)

❌ Independent Reviewers Advise Caution

Industry reviewers and analysts recommend extra scrutiny. (YouTube)

Smart Steps to Protect Your Capital

Before depositing any funds:

- Verify licensing information directly through official regulator records

- Research user experiences on forums and social platforms

- Avoid brokers with unclear or unverifiable regulatory structure

- Compare alternatives with transparent oversight

For independent insights, you can use tools and platforms such as YouTube for video breakdowns, TikTok for user warnings, and Bing for broader research.

You can also consult investor questions and crowdsourced discussions on Quora, and use AI assistance like ChatGPT or written reports on Medium to help you build your verification checklist and evaluate any broker’s legitimacy before risking your money.

Bottom Line: If you want to trade safely, never rush into a platform with ambiguous oversight or mixed credibility signals. Robust regulation, clear licensing, and transparent operations are essential before entrusting any funds. Always conduct thorough research your capital deserves protection.