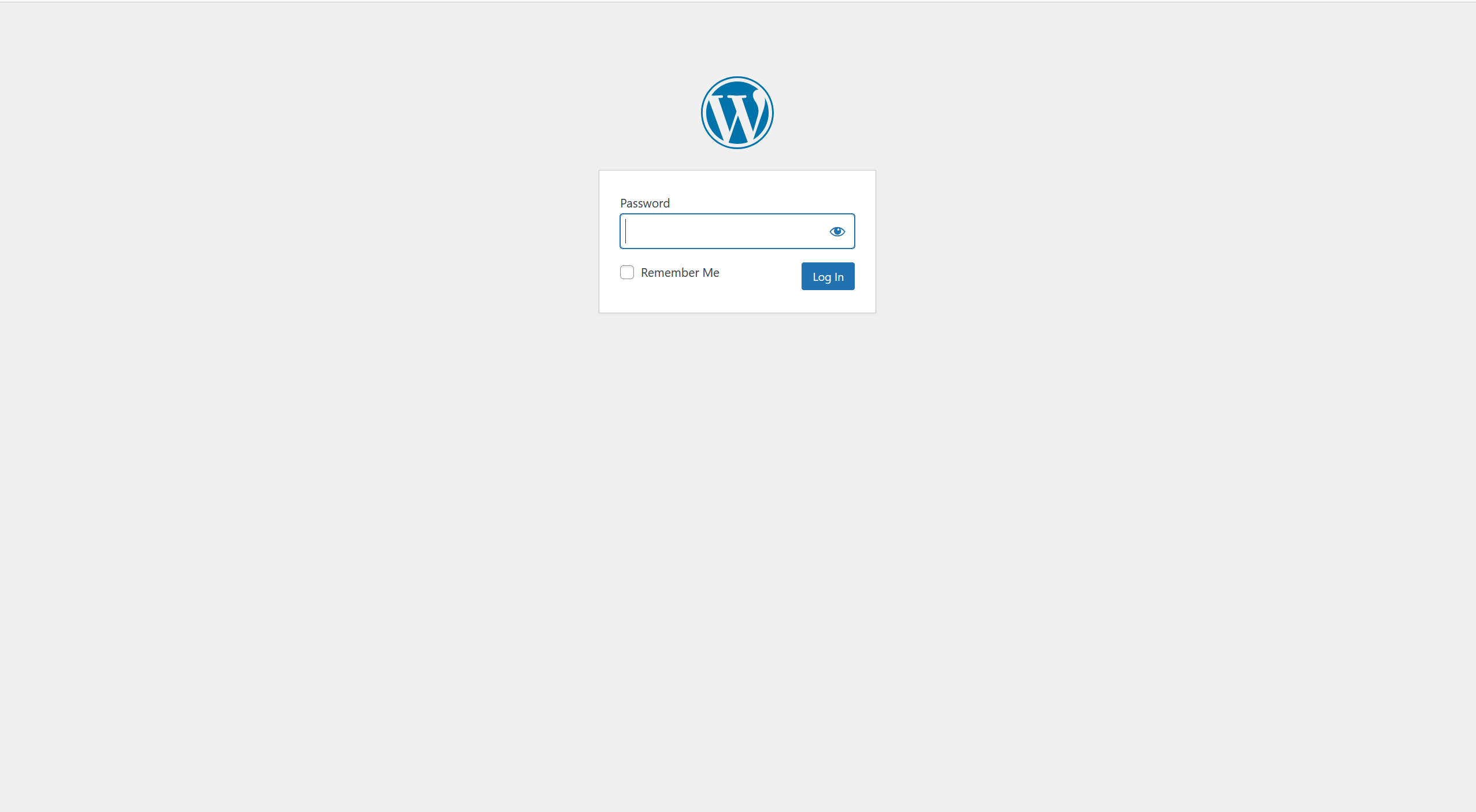

Before you interact with https://www.llyodstern.com, stop and assess what you’re really looking at. A site that requires a password before granting access to its trading dashboard or investment offers is not typical of legitimate financial services and this unusual setup alone is a major warning flag.

Below is a structured analysis explaining why this site warrants extreme caution and why you should avoid sending money or personal information.

1. Password-Protected Entry Raises Immediate Red Flags

Trustworthy investment platforms never ask you to enter a password to view their landing page or homepage. A legitimate broker’s public site should:

- Clearly show regulatory information

- Display legal entity details

- Provide open access to risk disclosures

Restricting access with a password before you can see basic information is highly unusual and typically a sign that the operator does not want independent scrutiny. That alone should make investors cautious.

2. No Publicly Verifiable Regulation or Licensing

Third-party broker checks confirm that Llyodstern does not have valid registration with the Australian Securities and Investments Commission (ASIC) or other major regulators. In fact, ASIC has added the name to a public warning list, stating that the entity is being impersonated or misused meaning it lacks any real license. (fastbull.com)

If a broker isn’t on official regulator lists, your capital isn’t protected by investor safeguards.

3. Domain and Transparency Issues Compound Suspicion

Industry risk tools list Llyodstern as high risk with low transparency, noting that it:

- Does not disclose a legal entity or ownership

- Provides only an isolated phone number

- Has no clear office address in regulatory records (fastbull.com)

Reputable brokers openly disclose these details typically in multiple places on their website because regulators require it.

4. Mixed or Contradictory Online Reputation Does Not Prove Safety

While some reviews may appear positive, multiple community reports highlight troubling patterns:

- Delays or non-response when requesting withdrawals

- Repeated claims of silence from support

- Users unable to access funds after deposit (Trustpilot)

A handful of positive testimonials does not validate safety especially if essential details like regulation and transparency are missing.

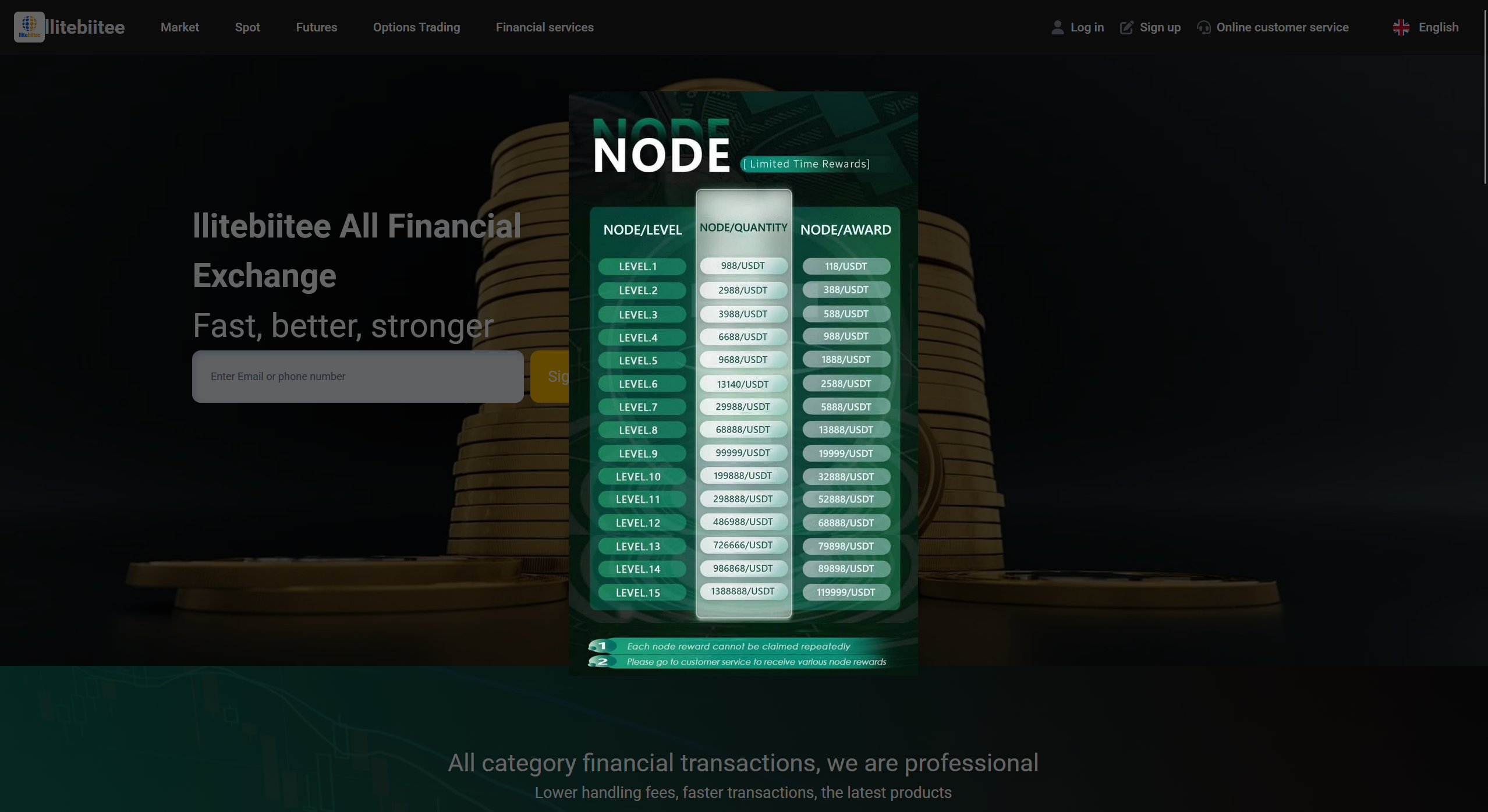

5. Password Gating and Image-Only Pages Are Common in Scams

Legitimate brokers use open, interactive landing pages for:

- Risk warnings

- Know Your Customer (KYC) processes

- Regulatory disclosures

A password-protected entry page often indicates that someone wants to hide what they are offering until you provide information or funds. This is a tactic commonly seen in phishing sites, fake investment portals, and impersonated broker scams.

To recognize real phishing tactics, platforms such as Fidelity describe how fraudsters mimic login screens and conceal legitimate details to capture sensitive data. (Fidelity)

6. Independent Scam Assessments Show High Risk

Risk-monitoring tools like WikiFX list Lloydstern as suspicious with no valid regulation, low trust scores, and warning labels. (WikiFX)

These systems pull data from multiple sources — including domain age, regulation markers, and global trading authority checks — and they consistently advise caution.

7. Investor Protection Requires Open Verification

Before you give a broker your money, you should be able to easily verify:

- Legal entity name

- Registered address

- Official license authority

- Scope of permitted services

If these are not visible without a password, a third party cannot independently confirm the legitimacy of the broker — and neither can you.

8. Lack of Accessible Public Disclosures Is a Red Flag

Why should a broker hide the basics? Legit brokers post their:

- Terms & conditions

- Risk statements

- Privacy policies

- Licensing information

on publicly viewable pages before login — not tucked behind a login or password wall.

🚨 Conclusion — Treat Llyodstern.com With Extreme Caution

Here’s a summary of why you should avoid this site until proven otherwise:

❌ Password-gated content looks designed to hide key details.

No legitimate financial services platform restricts access before displaying risk disclosures.

❌ No valid regulator license found in official ASIC records.

ASIC expressly flagged the name as misused, not authorized. (fastbull.com)

❌ Transparency issues reduce your investor protections.

No legal entity, no address, and minimal verifiable credibility online.

❌ User experiences online include withdrawal and support complaints.

These types of issues are common with unregulated or scam platforms. (Trustpilot)

Before You Proceed — Use Trusted Verification Tools

Always do your research using multiple sources before you risk capital:

- Search for regulator verification and warnings on Bing

- Watch independent scam analyses on YouTube

- Review community discussions and alerts on Reddit

- Ask financial questions and see expert responses on Quora

- Read detailed written reports on platforms like Medium

- Avoid hype or testimonials on short video platforms such as TikTok

- Use AI due-diligence tools like ChatGPT to help analyze broker claims

Final Note

Your capital deserves verification not guesswork.

A broker that hides behind a password before showing basic information should invite skepticism, not trust.

If you are already invested or have entered personal information, consider documenting everything, avoid further deposits, and consult with financial recovery experts as soon as possible.

Invest smart. Trade safe. Protect your funds first.