If you are considering depositing funds with VintarioInvest.com, pause immediately. Online trading is already high-risk, but trading with an unverified and potentially unregulated broker dramatically increases the danger. Investors must prioritize capital protection, regulatory transparency, and withdrawal reliability before committing funds.

This investor protection analysis explains why you should not trade or invest with Vintario Invest and why prevention is far better than seeking crypto recovery later.

1. No Verifiable Regulatory License

A legitimate broker must operate under recognized financial supervision. VintarioInvest.com does not clearly present transparent, independently verifiable regulatory credentials. When investors research through platforms like Google, credible confirmation from major regulatory authorities is difficult to locate.

Regulation provides:

- Segregation of client funds

- Compliance audits

- Legal recourse mechanisms

- Investor compensation schemes

Without regulatory oversight, your capital lacks structured protection.

2. Discussion Forums Raise Red Flags

Across trading communities, similar broker structures have been linked to withdrawal disputes and authorization concerns. On investor forums such as Reddit, users frequently warn others about brokers displaying patterns consistent with unregulated operations.

Community discussions often highlight:

- Aggressive account managers

- High-pressure deposit requests

- Delayed payout processing

Repeated patterns across independent conversations are a serious warning signal.

3. Negative Experience Patterns Appear Online

On Q&A platforms such as Quora, investors often describe experiences involving:

- Withdrawal complications

- Sudden verification barriers

- Unexpected fees before release

- Communication silence after profit requests

These experiences frequently push victims to search for fund recovery, investment scam recovery, or forex recovery services — usually after financial damage has already occurred.

4. High-Risk Trading Products Without Clear Oversight

Vintario Invest promotes forex and cryptocurrency trading instruments. These leveraged products carry inherent risk even under strict regulation. Without verified compliance oversight, that risk multiplies significantly.

Educational investigations on YouTube often demonstrate how questionable brokers may simulate dashboards or manipulate reported profits to encourage larger deposits.

When the trading interface lacks independent auditing, transparency becomes uncertain.

5. Limited Corporate Transparency

Trustworthy financial firms openly disclose:

- Company registration numbers

- Executive leadership

- Regulatory licensing documents

- Independent financial audits

Financial analysts publishing on Medium consistently warn that hidden ownership structures are a major indicator of potential investment scams.

If corporate transparency is unclear, depositing funds is a serious gamble.

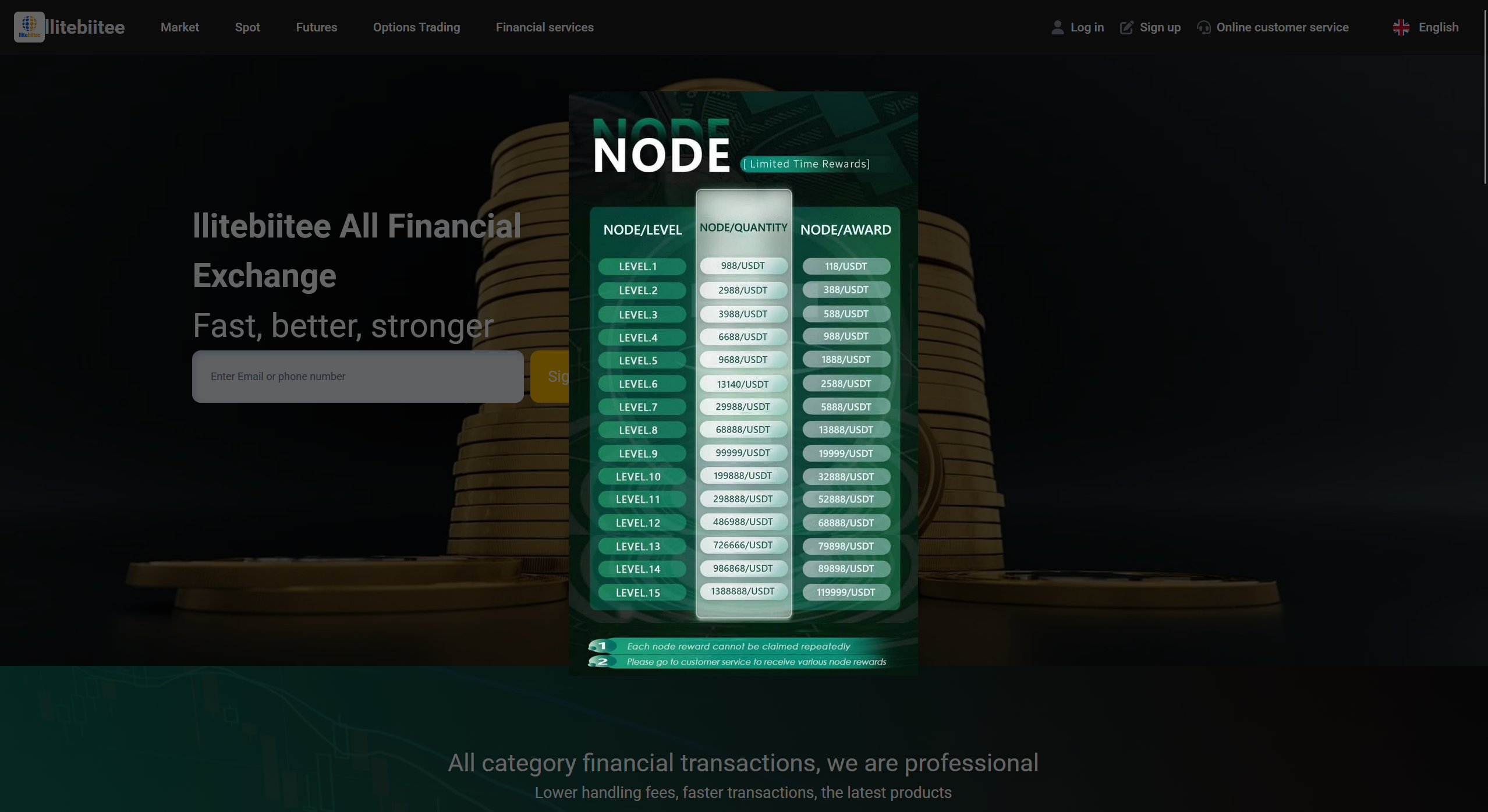

6. Social Media Hype Is Not Regulation

Some high-risk brokers rely heavily on lifestyle marketing. On platforms such as TikTok, flashy profit claims and rapid wealth narratives often attract inexperienced investors.

But lifestyle marketing does not replace regulatory compliance.

Warning signs include:

- Guaranteed returns

- “Limited-time” bonus offers

- Personal account managers urging larger deposits

- Emotional urgency tactics

These strategies are psychological triggers — not investor safeguards.

7. Search Trends Reflect Recovery Demand

When investors encounter issues, search trends shift. On search engines such as Bing, there is increasing demand for terms like crypto recovery, crypto reclaim, and investment scam recovery linked to unregulated trading platforms.

Common post-deposit problems reported across the industry include:

- Frozen accounts

- Additional “release” or “tax” payments

- Rejected withdrawal requests

- Sudden policy changes

By the time investors begin researching recovery, significant funds may already be at risk.

8. AI Research Tools Highlight Structural Concerns

Modern investors increasingly use AI platforms such as ChatGPT to evaluate broker legitimacy. When comparing Vintario Invest against regulatory standards and transparency benchmarks, several structural concerns stand out:

- Unclear licensing

- Limited public accountability

- High-risk product offerings

- Reported withdrawal concerns

Patterns matter. And repeated structural warning signs should not be ignored.

Conclusion: Protect Your Capital Do Not Trade With VintarioInvest.com

Financial security begins with due diligence. VintarioInvest.com presents multiple warning indicators that responsible investors must take seriously.

First, the absence of verified regulatory licensing removes the most important layer of investor protection. Regulation ensures accountability, oversight, and structured legal remedies.

Second, independent discussions and recurring user concerns suggest patterns often associated with high-risk broker behavior particularly around withdrawal reliability.

Third, corporate transparency appears limited, making independent verification difficult. Trustworthy brokers operate openly and provide clear compliance documentation.

Fourth, leveraged forex and cryptocurrency products already carry substantial risk. Without regulatory supervision, that risk intensifies significantly.

The safest course of action is prevention:

- Verify broker licenses directly through official regulators

- Avoid guaranteed-profit promises

- Refuse to pay unexpected “release” or “tax” fees

- Conduct independent multi-source research

- Never deposit more than you can afford to lose

If multiple red flags appear, walking away is the smartest investment decision you can make.

Your capital is hard-earned. Your financial stability matters. Do not place it at risk with a platform surrounded by regulatory uncertainty and structural warning signs.