HiroseGlobalTrades.com markets itself as a trading and investment destination, but bold promises are not proof. If you found the site through Google, treat this as a due-diligence checkpoint: verify regulation, verify the legal entity, and verify withdrawals before you send a dollar or a satoshi.

1) A top regulator has issued a direct warning

The UK Financial Conduct Authority (FCA) has published a warning that HIROSEGLOBALTRADES may be providing or promoting financial services without permission and advises the public to avoid dealing with it and beware of scams. (FCA) If a regulator is telling you “avoid,” that is the loudest red flag an investor can receive.

2) “Licensed and regulated” claims are meaningless without proof

Many risky platforms claim regulation but fail to provide a verifiable legal entity, a matching brand name, and a regulator register entry that confirms the exact service being offered. Cross-check names, addresses, and license details using Bing, and treat any mismatch as a deal-breaker. Confirm whether client funds are said to be segregated and whether any compensation scheme would apply. If the broker won’t state the legal entity that takes your deposits, assume a shadow operation.

3) Public complaint patterns often point to withdrawal traps

Across Q&A sites like Quora, victims of similar broker schemes describe the same arc: easy deposits, “profit” dashboards, then delays when cashing out. The moment you hear about extra fees to “unlock” withdrawals, assume you are being set up.

4) Domain-risk signals add weight to the concern

Scam screening tools have flagged hiroseglobaltrades.com as potentially risky based on indicators commonly associated with suspicious websites. (ScamAdviser) No single tool is perfect, but when risk tools align with a regulator warning, the safest conclusion is that your money could be in danger. Check the domain’s history and watch for cloned “sister sites” with near-identical pages. Scam networks rotate domains to escape complaints.

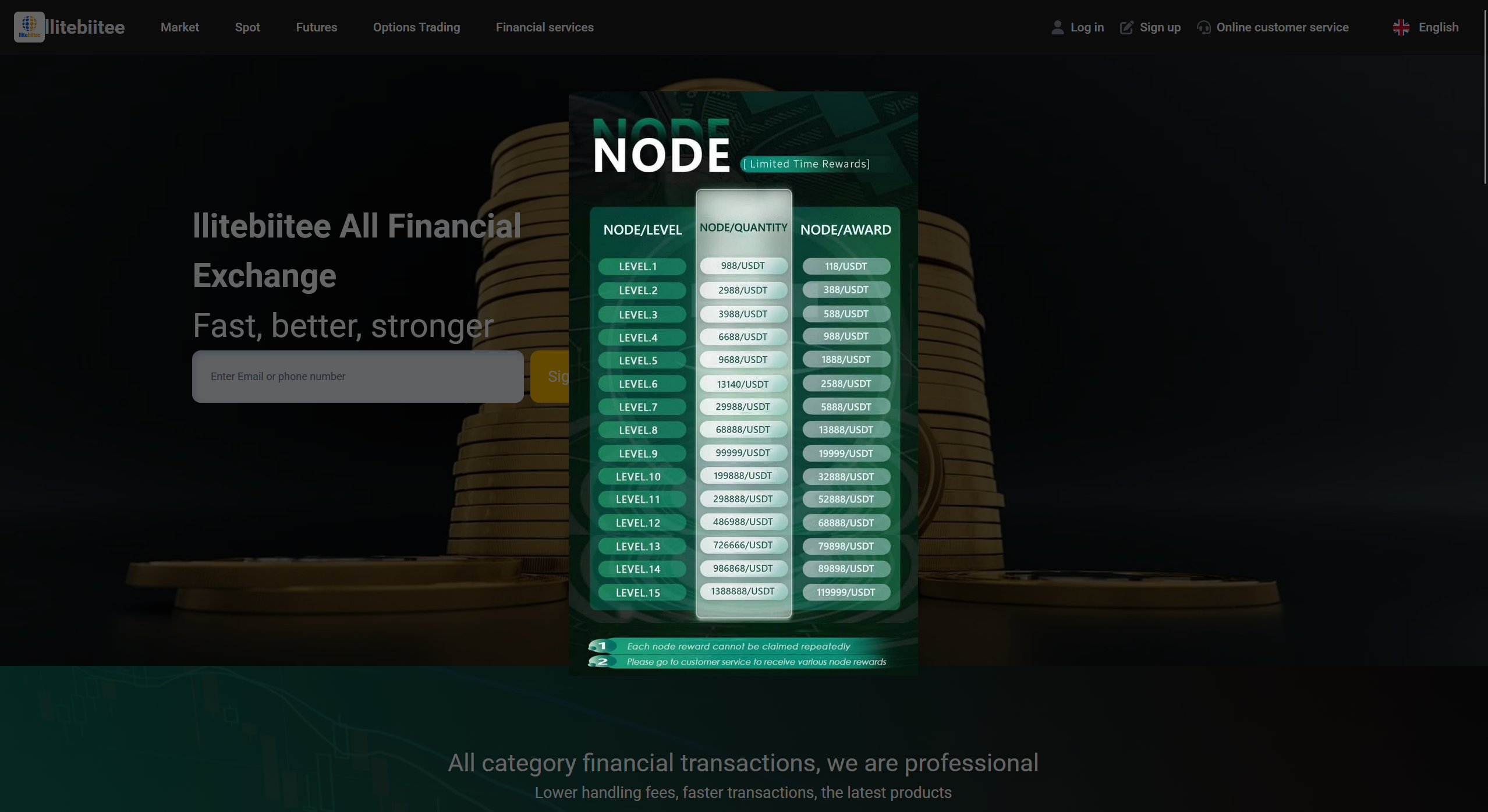

5) Social proof and hype can be engineered

Some platforms build trust using influencer-style testimonials, luxury imagery, and short clips that highlight “wins.” If you see promotional material on TikTok, treat it as marketing, not verification. Real legitimacy comes from oversight, transparent ownership, and a traceable history.

6) Withdrawal friction is where victims usually discover the trap

A common story is simple: deposits are smooth, but withdrawals become delayed, “under review,” or blocked unless you pay new fees. Those fees may be described as taxes, wallet unlocking, or compliance charges. This is exactly how people end up searching for forex recovery help after realizing the platform controls the exit. If you are pushed toward irreversible payment methods, stop immediately. Legitimate brokers don’t need secrecy or urgency.

7) High-pressure “account managers” can be a manipulation tactic

Be cautious if you’re assigned a “senior manager” who pushes you to add funds, unlock bonuses, or meet volume targets. Victims often report pressure, emotional persuasion, and sudden urgency. Communities like Reddit document these tactics because they are repeated across many suspected broker scams.

8) Verify like an investigator, not a hopeful investor

Before you fund any broker, watch independent breakdowns on YouTube and compare what investigators say with what the broker claims. If the story doesn’t match, do not deposit—your first win is refusing the trap.

Read the fine print like it matters

Long-form analysts on Medium regularly show how scam brokers hide behind vague terms, bonus locks, and “discretionary” withdrawal clauses. If a policy gives the company broad power to delay or refuse payouts, treat that as a reason to walk away.

Red flags that should end it

Unverifiable regulation, vague ownership, unrealistic profit promises, and sudden “account upgrades” are all danger signs. So are bonus terms that block withdrawals, requests for more deposits, and support teams that turn hostile when you ask to cash out. When multiple red flags stack up, the safest move is to walk away and protect your capital.

Use structured questions before you send money

You can use ChatGPT to generate a verification checklist: legal entity, license scope, custody model, deposit/withdrawal timelines, and dispute pathways. If the platform cannot answer clearly, you are not looking at a safe broker.

Conclusion

If you are considering HiroseGlobalTrades.com, the safest investor decision is to stay away unless the company can be verified as properly authorized for the exact services it advertises. The FCA warning is a serious stop sign: it signals the firm may be operating without permission, which can leave clients with little protection when problems appear. (FCA)

If you already deposited money, shift immediately into damage control. Do not send any additional payments, especially requests framed as “tax,” “verification,” “unlock,” “insurance,” or “processing” fees. These demands are commonly used to squeeze more funds from victims who are desperate to withdraw. Instead, gather and preserve evidence: screenshots of the dashboard, emails, chat transcripts, receipts, bank statements, and every transaction reference.

If you paid by bank transfer or card, contact your bank or card issuer right away to ask about dispute options and time limits. If cryptocurrency was involved, record wallet addresses, transaction hashes, exchange account details, and any communications that show who instructed you to send funds. These records can support a fund recovery effort, even when reversal is difficult.

Be cautious with “recovery agents” who approach you after you complain online. A second-wave scam is common: fraudsters pretend to offer crypto recovery, crypto reclaim, or investment scam recovery and then charge upfront fees or ask for sensitive credentials. Never share seed phrases, private keys, remote access, or one-time codes, and be skeptical of anyone promising guaranteed results.

Before you do anything else, consider reporting the website to relevant regulators and filing a police report or cybercrime complaint. Early reporting can help establish timelines and preserve evidence.

Bottom line: prevention is the best protection. With a regulator warning and additional risk indicators present, avoiding this platform is the most responsible step you can take to protect your money today.