If you’re considering signing up with InoQuant to trade forex, CFDs, cryptocurrencies, or other financial assets, STOP and read this first. Below is a thorough structured analysis explaining why this platform is risky, may be unregulated or unsafe, and why you should NOT trade or invest with them.

1. No Clear Regulatory Oversight or License

InoQuant markets itself as a modern investing platform, but there’s no evidence it’s regulated by a recognized financial authority such as the FCA (UK), CySEC (Europe), ASIC (Australia), or SEC (US). Independent warning sites label the website’s trust score as extremely low, often an indicator of scam activity. (ScamAdviser)

🔎 Without proper oversight, your investments have virtually no legal protection if something goes wrong.

2. ScamSafety Tools Flag It as Unsafe

Independent scam assessment tools (like ScamAdviser) give InoQuant a very low trust score, noting that:

- The site is newly registered and lacks public ownership info.

- Whois details are hidden (a common tactic to mask scammers).

- The registrar is often associated with high-risk or fake sites. (ScamAdviser)

⚠️ These patterns are classic red flags for high-risk or fraudulent brokers.

3. Mixed and Possibly Fake Reviews

Some online review aggregators show positive reviews (like a 4.1 score), but detailed inspection reveals:

- High proportions of 1-star reviews flagging withdrawal issues.

- Comments about fake or misleading reviews being posted to boost appearance. (Trustpilot)

⚠️ When real user feedback is split and inconsistent, it suggests reviews may be manipulated to disguise a problem.

4. Promotional Claims Conflict With Reality

InoQuant’s site promotes:

- “Bank-level security”

- Instant account setup

- Complete transparency and expert support (inoquant.com)

However, there’s no verifiable evidence other than their own marketing to support these claims. Legit, regulated brokers typically display official license numbers and links to regulators — InoQuant does not.

5. Multiple Scam Alerts From Third-Party Reviews

Several independent analysis videos and scam warning sites explicitly label InoQuant as unregulated and unsafe, claiming users have lost money and struggled to withdraw funds. (YouTube)

🛑 These warnings often come from people who investigate scam patterns, not from paid marketing.

6. Withdrawal and Account Conditions Can Be Risky

Official policies (InoQuant’s own Terms and Withdrawal Policy) highlight:

- They may delay or restrict withdrawals for “security reasons.”

- Extra fees may apply to profit withdrawals.

- Identity verification and manual checks are required before processing. (inoquant.com)

⚠️ While that may sound normal for regulated brokers, in the context of low trust and lack of oversight, these conditions become mechanisms to withhold funds.

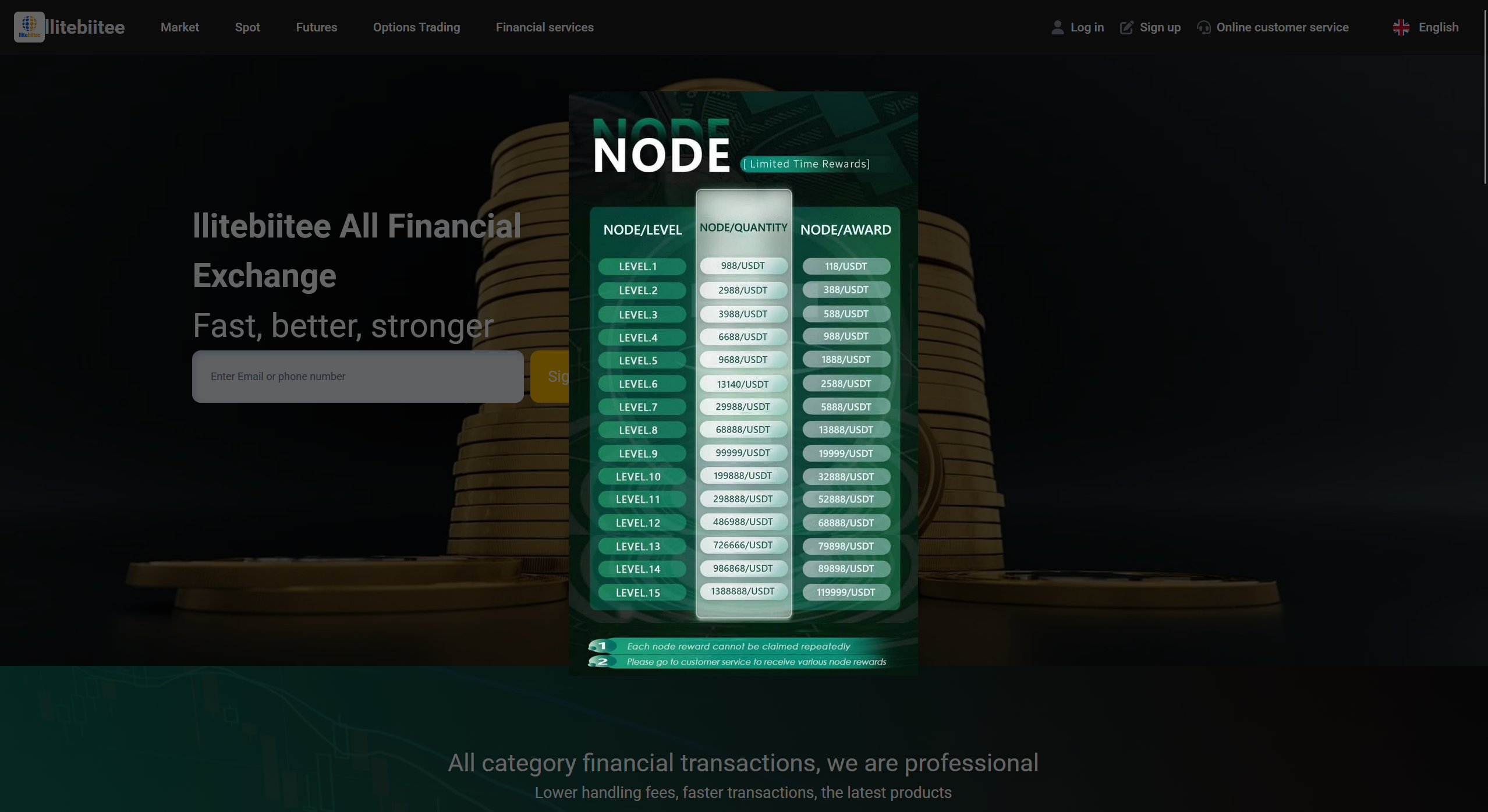

7. Hidden Bonus & Volume Requirements

The platform imposes trading volume requirements to withdraw bonuses — a tactic sometimes used by scam brokers to trap funds. (inoquant.com)

💡 Bonus schemes with high rollover requirements can be a strategic barrier to withdrawals.

8. Risk of Simulated Trading Dashboards

Some scam investigations note classic boiler-room patterns:

- Users are shown fake profit dashboards to encourage larger deposits.

- These dashboards simulate profits that aren’t real market performance. (Recover Funds Canada)

📉 This can mislead traders into believing they’re doing well — while the operator still controls the money.

9. Lack of Transparency on Ownership & Legal Basis

Professional and safe brokers disclose:

- Company registration info

- Regulatory license numbers

- Audited financial statements

InoQuant’s site does not provide verifiable legal registration or transparent corporate info — and independent scans confirm this omission. (ScamAdviser)

❗CONCLUSION: Do NOT Trade or Invest With InoQuant

Here’s a summary of why you should stay away from this platform:

🚫 No Regulation = No Legal Protection

Investors risk their funds with zero oversight or recourse.

🚫 Website Safety Tools Flag It as High-Risk

Hidden ownership and low trust scores are classic scam signs.

🚫 Withdrawal Barriers & Conflicting Reviews

Withdrawals may be delayed, restricted, or blocked — while positive reviews are possibly fake.

🚫 Marketing Claims Don’t Match Independent Findings

Their promotional language is not backed by verifiable, credible evidence.

If you want to trade online, only use brokers that are fully regulated by respected authorities such as the FCA, CySEC, ASIC, or SEC — and always verify their license directly on the regulator’s website before depositing funds.