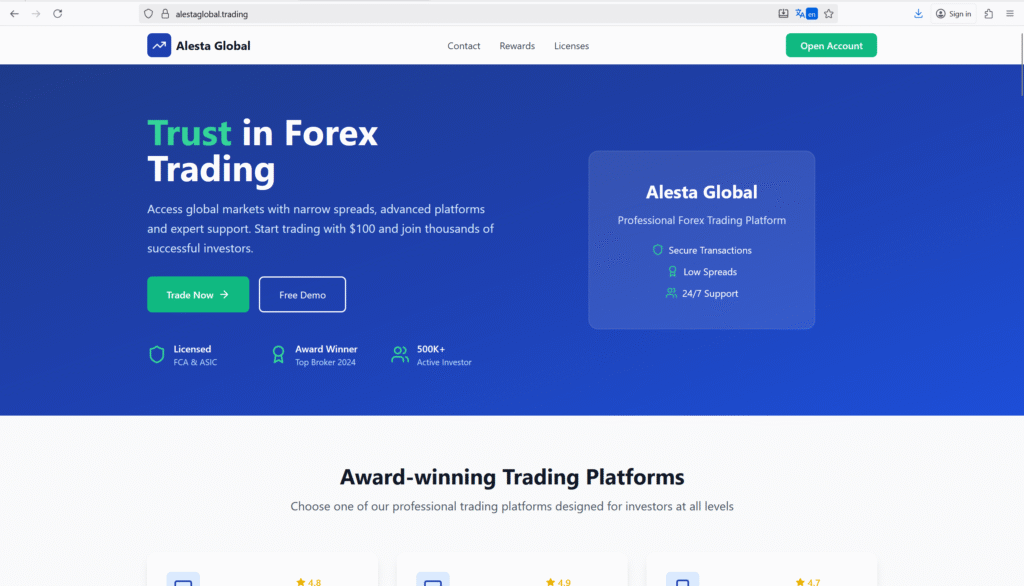

When a trading site surfaces overnight and promises fast profits, abundant leverage, and low minimums, red flags must ripple. AlestaGlobal.Trading operates in exactly that space—slick interface, big promises, and almost no verifiable footprint. Beneath the polished gloss, dangerous inconsistencies, regulatory warnings, and user alarms converge. These are the 7 savage truths that unmask AlestaGlobal.Trading as more predator than provider.

The first savage truth: no credible regulation or license. AlestaGlobal.Trading appears on ASIC’s investor alert list, marked as an unlicensed entity targeting Australians. (ASIC warns the public that it is not authorized in Australia.) This is no casual oversight: a national regulator has officially flagged it. Meanwhile, broker-watch aggregators like WikiFX list “No Regulation” for Alesta Global, with explicit warnings about risk. In legitimate trading, regulation is a backbone of trust. Without it, a broker is a ghost operating beyond viable accountability.

The second savage truth: massive complaint volume and no payouts. On Trustpilot, every review so far is a one-star outcry: “entirely deceitful,” “no payout,” “don’t trust.” One user claims they deposited and saw projected gains—but when they attempted withdrawal, the broker opaque-blocked them. The matching pattern across multiple users is unmistakable: deposit, simulated returns, then withdrawal roadblocks and silence. That is the scam blueprint in motion.

The third savage truth: official “scam confirmed” classification. BrokersView, a site cataloging fake/unregulated brokers, lists Alesta Global under its “Scam Confirmed” section. They cite its unregulated status and inclusion in ASIC’s alerts. If a specialized industry watchdog has already exposed it, that’s not a rumor—it’s a public record. One cannot claim plausible deniability when your name is in lists of known fraudulent platforms.

The fourth truth: opacity in structure, ownership, and terms. Legitimate brokers publicly disclose their corporate entity, leadership, auditing firms, and legal disclosures. AlestaGlobal.Trading provides none of that. Contact emails, phone numbers, and corporate addresses are either missing, vague, or unverifiable. Such anonymity is a red flag. Fraud relies on disappearing acts; anonymity is the open door.

The fifth savage truth: predatory marketing and pressure tactics. Reviews suggest users are contacted aggressively—calls, emails, social media outreach—urging quick deposits, promising guaranteed returns, and offering “special” leverage or bonuses. This push-push tactic is classic phishing of trust. Once someone is lured in, they are pressured to deposit ever more, until their funds are trapped.

The sixth savage truth: mirage of legitimacy via third-party clones and echoes. AlestaGlobal.Trading mirrors dozens of other scam sites in structure, fake “regulated” claims, and recycled templates. It appears to be part of a broader network of cloned brands that pivot domains when threatened. When one site is shut, another rises just like it. This systematic mirroring is not coincidence—it’s deliberate design in the scam industry.

The seventh and final harsh truth: exit strategy baked in. Because it is unregulated, anonymous, and already flagged, AlestaGlobal.Trading can vanish at any moment. Domains may shift, funds are moved, accounts locked. Victims are left chasing shadows. The business model itself seems built for a collapse once enough money accumulates. The registration may already be phantom, and that gives operators plausible escape routes.

Together, these seven savage truths expose AlestaGlobal.Trading not as a broker, but as a well-disguised trap. The façade of legitimacy—charts, leverage, account tiers—is a lure. The absence of enforceable regulation, transparency, and payout history confirms the core: it is a platform designed to extract, not trade.

Conclusion

To anyone considering AlestaGlobal.Trading, proceed only with extreme skepticism. It is not a broker you can trust—it is a risk vector engineered with tactics drawn from the fraud playbook. The combination of regulatory warnings, confirmed scam classification, nonpayment reports, opaque structure, and patterned marketing tactics makes this platform fundamentally unsafe.

If you already deposited funds there, act immediately. Stop further deposits. Attempt a small withdrawal as a test. Document all your transactions: bank statements, chats, emails, screenshots. Contact your payment provider or bank to lodge a dispute. Report this entity to your local financial regulator and consumer protection agency. The sooner you mobilize, the better your chance at recovery.

Do not cling to hope that this is “recoverable.” Scam brokers exploit the psychology of desperation; they promise returns while plugging exits. Many victims hold on for months before realizing the trap. You must break free quickly, because delay strengthens their defenses.

Also, avoid “recovery agents” who claim they can get your money back—for a fee. Many of these are secondary fraudsters. Seek agents with verified track records, full transparency, and legal credibility.

AlestaGlobal.Trading exemplifies a broader warning: in the digital trading ecosystem, brilliance of design and slick branding are no guarantee of integrity. The more polished a site looks, the harder its weave of deception may run. Always test legitimacy through third-party verification, regulatory registries, and independent user feedback—not just by how good the interface looks.

This article should not only serve as a warning, but as a guidepost. The more victims raise their voices, the more patterns are exposed. Regulators and investigators benefit from complaints and documentation—you may not recover all, but you can help prevent the next victim.

In closing, trading platforms like AlestaGlobal.Trading are not partners—they are predators in drag. Do not assume goodwill; approach every new broker with caution until proven otherwise. Demand proof, insist on regulation, test withdrawals, and never surrender your funds without verified recourse.