Focus Keyphrase: BtcTurk Hisse vigilance review

When you’re trading via the BtcTurk | Hisse platform, you are entering an arena where speed, ambition, and digital access collide with regulatory complexity, hidden costs, market volatility, and liquidity pressure. With every app-based investment service, the promise of “low cost” and “instant access” masks deeper risk. Whether you saw a slick ad, read a post on reddit.com, searched via google.com, scanned analysis on medium.com, asked a question on quora.com, or used chatgpt.com for advice — the urgency remains: scrutinise the platform, understand the hazards, protect your capital.

If you already entered trades, held funds, or have suspicion you might be locked into unexpected terms — don’t wait. Act now

Let’s inspect eight ruthless signals you must identify and demand answers to, before further committing to BtcTurk | Hisse or similar digital brokerage services.

1. Instant Access Tempts, But Brings Liquidity Risk

BtcTurk | Hisse advertises features such as “Hemen Kullan” (immediate use) of sale proceeds. (bilgiplatformu.btcturk.com) While this sounds advantageous, instant liquidity can increase risk if markets move suddenly, or if settlement mechanisms are opaque. You may believe you’ve exited a position — but delay, technical faults or internal policy may still leave you exposed.

2. Zero-Commission Claims Don’t Nullify All Costs

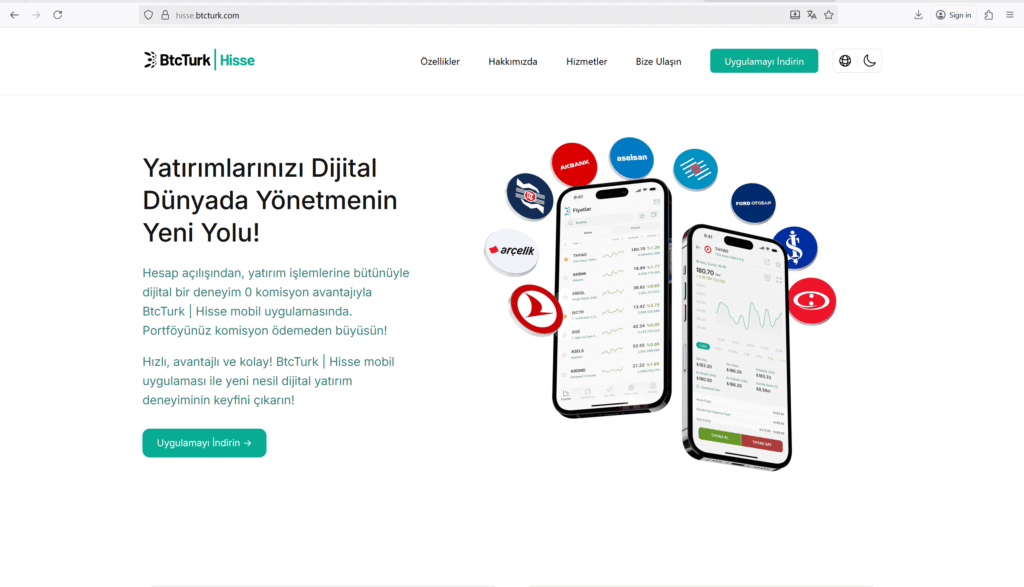

The promotion of “0 komisyon” for share trades on Borsa Istanbul through BtcTurk | Hisse is prominently featured. (hisse.btcturk.com) But zero commission is not cost-free. Hidden spreads, execution delays, application limitations, account transfer restrictions or app-specific fees might still apply. Do not allow the “zero commission” label to lull you into thinking risk is eliminated.

3. App-Based Platforms Often Mix Asset Classes

BtcTurk is known primarily for cryptocurrency trading, yet the Hisse branch proposes equity trading. That crossover can blur operational practices, support frameworks, risk disclosures and oversight. The deeper you go, the more mismatched the app interface, support, access rules may be. Be alert.

4. Rapid Deployment Can Hide Contractual Complexity

BtcTurk | Hisse emphasises ease, digital onboarding and minimal friction. (hisse.btcturk.com) But with high-speed entry comes shallow contract review, unclear exit rights, or ambiguous jurisdictional terms. If you signed without fully reading the client agreement, you may face unexpected lock-in or regulatory ambiguity.

5. Negative User Feedback Signals Operational Fragility

Investor complaint portals report issues like delayed fund transfers after share sales, unresponsive support and unauthorised activity notifications for BtcTurk | Hisse. (sikayetvar.com) These are warning flags that must not be ignored. When app review complaints surface, treat them as risk signals, not isolated incidents.

6. Cross-Product Transfer Features Are Convenient — But Increase Exposure

The feature allowing transfer of TL from Hisse to Kripto accounts within the same group is convenient — but linking trading of highly different asset classes (equities + crypto) increases systemic exposure. Volatility in one domain may leak into the other. You must clearly segregate your risk, not unify it blindly.

7. Regulatory & Settlement Details Are Different than Traditional Brokers

BtcTurk | Hisse claims “oransal işlem” (fractional share) access to overseas stocks, and other features such as same-day settlement. (hisse.btcturk.com) These features might appear beneficial, but they often carry different terms: fractional ownership versus full share rights, foreign asset custodians, cross-border regulatory risk. Understand whether you hold actual equity or derivative exposure.

8. If Something Feels Off — Immediate Exit Must Be Ready

When you detect poor communication, unclear documentation, unexplained delays or pressure to trade without consent — do not wait. Stop deposits. Investigate. Escalate. If you cannot extract your funds within the promised timeframe, you may need specialist help —

Exclusive Conclusion: Don’t Trade Blind. Define, Defend, Demand.

The appeal of BtcTurk | Hisse is strong — digital trading, equity access, instant movement, app-first interface. But promise is no substitute for protection. In a financial environment where app-based brokers can innovate faster than regulation, you yourself become the frontline defence. Don’t let simplicity become your excuse for skipping due diligence.

You must behave like a strategic investor, not a naive user. That means:

- Demand full transparency: contract terms, custody rights, settlement mechanisms.

- Verify the offline support: phone, live chat, documentation, jurisdiction.

- Exit readiness: know how quickly you can move your funds, what fees apply, how your assets are held.

- Diversification and segregation: don’t funnel all assets into one “cheap-digital” account.

- Regular review: check for complaints, bugs, regulatory updates. For example, the community forums on reddit, or user-review sites like those on bing.com or quora.com often reveal early risk patterns.

If you have already used BtcTurk | Hisse and are unsure about your funds, withdrawal terms or trade execution — do not delay. Your right to reclaim may degrade with time. RECLAIM NOW.

In the end: your capital deserves more than access — it demands control.

Platforms may boast speed, low cost and convenience — but true value lies in security, transparency and exit power.

So when you next open the BtcTurk | Hisse app, pause.

Don’t click “Buy” until you’ve interrogated the contract.

Don’t deposit funds until you’ve read the settlement clause.

And don’t assume zero commission means zero risk.

If someone from the platform contacts you with “exclusive offer” or “VIP trading” pause.

Because you may be walking into the most dangerous part of digital finance: your own overconfidence.

And if you suspect you were mis-led: stop trading, secure proof, request your funds RECLAIM NOW.

Your trading freedom is real but only if you protect it with intelligence, not optimism.

Stay alert. Stay ruthless. Stay in control.

RECLAIM NOW.

Would you like this article translated to Turkish, formatted for a blog, or turned into a downloadable PDF?