When you’re considering schemes like Eminevim that promise “interest-free housing ownership” in Turkey, you must adopt a warrior’s mindset — because behind the friendly branding and “no loan/interest” message lies complexity, risk, and the potential for surprise losses. With rising inflation, hidden fees, and non-transparent delivery models, the investor cannot afford complacency.

If you’ve already committed funds, given up savings, or entered into membership without clarity you must act now RECLAIM NOW.

Online forums and threads (on platforms like google.com, reddit.com, medium.com, quora.com, chatgpt.com, and bing.com) contain dozens of complaints about saving-based housing cooperatives, long wait times, inflation erosion, and unclear contractual terms. Eminevim itself is well-known and regulated, but that does not mean it’s immune to every risk. Therefore: be alert. Be prepared. Be relentless.

1. The “Interest-Free” Label Doesn’t Mean Risk-Free

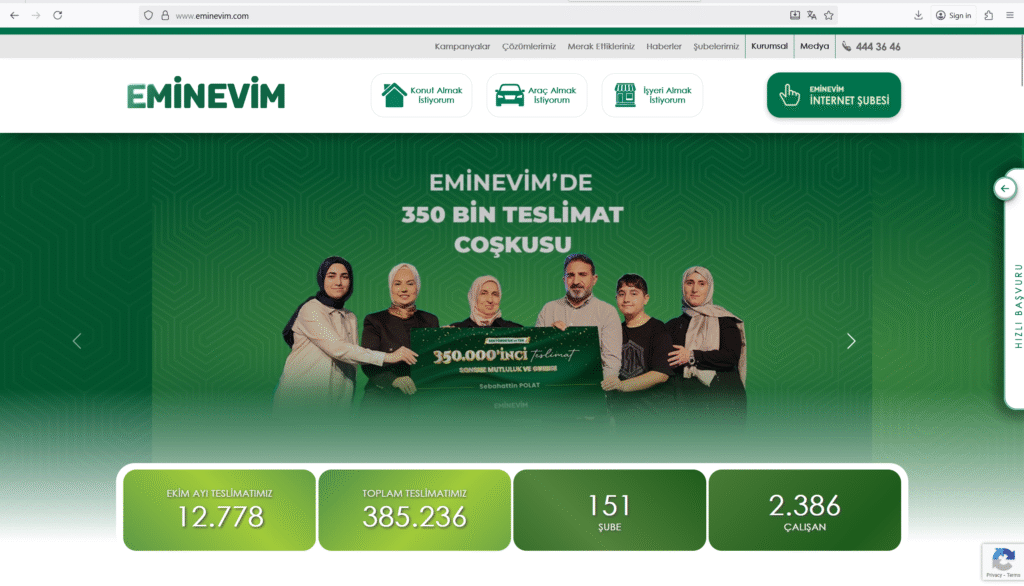

Eminevim markets itself as offering home ownership without paying interest. (www.eminevim.com) That terminology sounds attractive — but “sans interest” often hides other cost structures, fees, escrow hold-backs, or inflation dilutions. Don’t assume “interest-free” equals “cost-free” or “safe”.

2. The Delivery Timing Is Often Uncertain

According to users in discussion threads, you may pay installments for long periods before being allocated your property. (Reddit) If you are drawn late in the cycle, inflation may erode your purchasing power and you may face delays — risk that must be accounted for.

3. The Model Relies On New Entry & Continuous Funding

Academic studies of saving-based cooperative systems in Turkey (including Eminevim) show that part of the system’s operation depends on fresh participants entering and paying in. (ResearchGate) If growth stalls, pressure builds, and the system’s sustainability can be challenged.

4. Inflation & Real-Estate Price Increases Can Offset Your “Gain”

One Reddit commenter wrote:

“Catch is inflation. … If you can get the money early… you may get a cheap loan… if you’re not lucky, when you get the money, it might be worthless.” (Reddit)

Relying on being “picked early” is a gamble — if prices keep rising, the effective cost of your unit is higher than you anticipated.

5. The Draw & Allocation Mechanism Adds Luck to Your Home-Ownership Equation

Documentation shows Eminevim uses “lottery / draw” systems and fixed-term systems for allocation of houses. (www.eminevim.com) That means timing and luck play a major role in when you actually get the home — making your commitment less certain than a standard mortgage contract.

6. Regulatory Oversight May Be Less Rigorous Than Bank-Loan Systems

The academic analysis warns that saving-based cooperative finance systems may not always have the same transparency or guarantee mechanisms as conventional banking lending. (ResearchGate) You must scrutinise the fine print: termination clauses, default rules, exit rights, membership rights.

7. Your Funds Are Locked In — You Can’t Always Just Withdraw Easily

Once you participate, you commit to a schedule of payments. If you exit early, you may lose benefits or face unwelcome penalties. The academic study states lack of clarity in exit and insolvency handling. (ResearchGate)

8. Avoid Comparing It To A Traditional Mortgage Without Checking Terms

A traditional mortgage will give you a home immediately and charge interest. The Eminevim model gives you a home after a wait, sometimes subject to luck, sometimes higher cost relative to inflation. A Reddit user put it bluntly:

“You pay less in eminevim but … you pay installments and a rental for wherever you live for an unknown period.” (Reddit)

Understand the full cost, timing, and trade-offs.

9. If Something Feels Vague — Act Immediately

If you’re unsure about the contractual terms, delivery timetable, inflation adjustment clauses, or exit mechanisms — you must not proceed without full clarity. If you already did — pause payments, review your contract, seek specialist advice, and prepare for recovery if things go wrong. RECLAIM NOW.

Exclusive Conclusion: Don’t Wait For The Draw — Take Control Now

Believing in the model of Eminevim might feel righteous — after all, you’re buying a home, avoiding interest, opting for a “halal” solution — yet hope is not a strategy. You are entering a system where your timing, your relative payment, your group placement, and the state of the economy combine to determine your outcome. That means your risk is non-negligible.

Being passive in a money-commitment system is dangerous. You must assume you’re in a delayed-gratification system with built-in risk — just because the brand is established doesn’t erase those structural factors. For every early winner, there may be many late entrants facing higher cost, longer wait, or inflation-eroded benefit.

If you’ve already entered the system and something doesn’t add up — ambiguous clause, unexpected adjustment, long wait — don’t hope it will fix itself. Hope kills recovery. Act. Review. Exit if necessary. Engage professional help if needed RECLAIM NOW.

Consider this: real estate markets shift. Inflation climbs. Regulatory changes may arise. The longer you’re locked into a commitment without clear deliverable, the more exposed you become. The pomp of “interest-free ownership” must be weighed against your control, liquidity, knowledge, and exit options.

Your home is your biggest asset. Don’t let it become your greatest vulnerability. Demand:

- A clear delivery date.

- Transparent cost breakdown minus inflation.

- Understandable exit terms.

- Written explanation of the draw system and your position inside the group.

- Transparent disclosure of how your payments are used.

If you cannot obtain all of these, step back. Because you should not be funding a gamble disguised as “solid cooperative financing”.

When you press “join” on Eminevim (or any similar institution) do not let your heart lead, let your logic dominate. Be the gatekeeper of your future, not the follower of good-sounding words.

If you already handed over your payments without clarity, you must act now, monitor, contest, and if necessary reclaim because recovery becomes harder with time. Don’t let delay deepen your loss. RECLAIM NOW.

Stay alert. Stay sovereign. And treat every home-ownership promise like the investment; it is not just a dream. RECLAIM NOW.