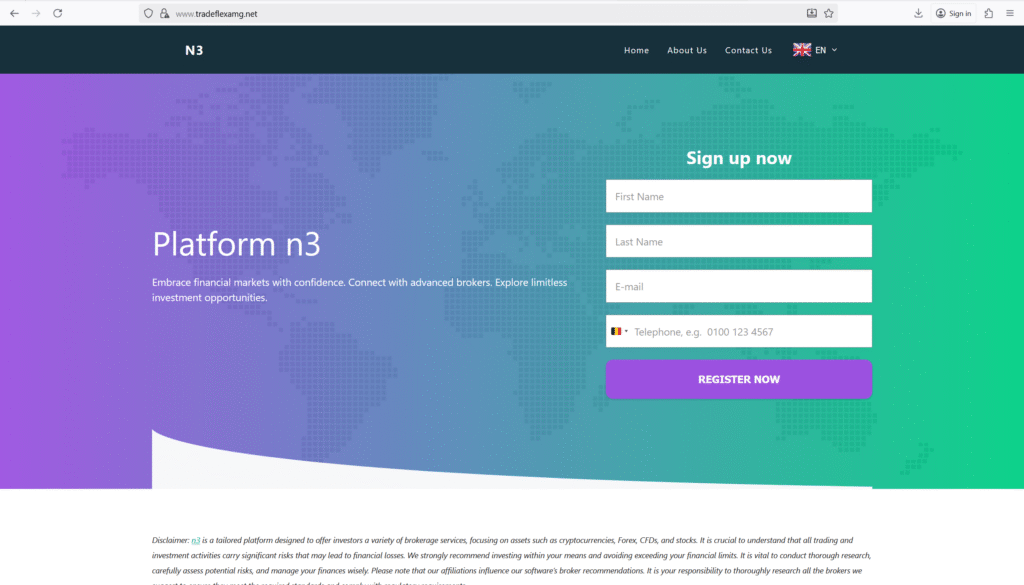

If you’re seeing ads or getting solicitations for Tradeflexamg via sites like “tradeflexamg.net” or variants about “TradeFlexAMG 8.1”, stop in your tracks. This platform is repeatedly flagged by multiple sources. According to FraudTracers:

“TradeFlexAMG offers online financial services yet holds no licence from any well-known regulator such as the Financial Conduct Authority (FCA).” (FraudTracers)

That means you are not dealing with a transparent, supervised broker—but potentially a loss-engine.

This Element 2 article uses eight relentless reasons to expose the danger and explain why you may need a full TradeFlexAMG scam recovery plan—covering blockchain tracing investigation, fund recovery services, chargeback crypto scam, report crypto fraud, investment recovery strategies. You’ll also see interactive references to google.com, reddit.com, chatgpt.com, medium.com, quora.com, and bing.com throughout.

➡️ RECLAIM NOW

1) No credible licensing or regulator oversight

Independent reviews show TradeFlexAMG is not registered with respected authorities such as the FCA, ASIC or SEC. (TheSafetyReviewer)

If the firm is not regulated, your funds have much less protection. Legally, you may be on your own.

2) Domains and variant apps create confusion

There are multiple sites and versions: tradeflexamg.net, tradeflexamg.com/en, tradeflexamg8-1.com, etc. (TradeFlexAMG 8.1)

This kind of brand-hopping or domain shifting is common in scam operations—making complaints harder to trace and your recovery harder to pursue. Browse real-user commentary on reddit.com for similar schemes.

➡️ RECLAIM NOW

3) Minimal transparency on company info

The site “tradeflexamg.net” lists no clear company registration number, no verified address or phone contact. FraudTracers flagged missing data for address, phone, and email. (FraudTracers)

When internal details are opaque, you lose a major pillar of recovery: knowing who to hold accountable. For more on how to vet brokers, search google.com.

4) Red flags in user review patterns

On Trustpilot, the company shows only a single review and an average score of ~3.2/5—but the one posted is a complaint of over US$75,000 loss. (Trustpilot)

One bad review does not prove a scam—but combined with absent licensing and opaque company info, it tilts meaningfully toward alert status.

5) High promise marketing, no proof of performance

Promotional pages claim “AI-powered trading”, “unlimited markets”, “automated profits”. Yet review sites find none of the independent audits or verifiable track records that legit brokers publish. (Techloy)

If you’re being sold guaranteed returns or slick dashboards rather than clear evidence of performance, you are likely in probe mode, not safe investing.

➡️ RECLAIM NOW

6) Withdrawal and recovery risk is very high

Given the regulatory gaps and opaque structure, once deposits are made, the risk of withdrawal delays, requests for “verification fees”, or outright fund loss is significantly elevated. Safety reviewers say exactly this. (TheSafetyReviewer)

If you already funded the account, you must shift your thinking from “trading” to “how do I recover my funds.” Consider reading up on medium.com posts about recovering from unregulated brokers.

7) If you’ve already engaged—time to act quickly

Here’s your immediate checklist:

- Stop depositing new funds and request a full withdrawal.

- Document everything: screenshots, bank transfers, wallet addresses, chat logs.

- Contact your bank or payment provider to initiate a chargeback or reversal in case of a crypto or card payment.

- If crypto is involved, launch blockchain tracing investigation services.

- File official complaints with your national regulator and publicly share your experience on quora.com and bing.com search results.

➡️ RECLAIM NOW

8) Prevention remains your strongest recovery step

If you haven’t yet deposited funds with TradeFlexAMG: don’t. The best outcome is no engagement.

Before you ever deposit with any broker: verify regulatory status, company ownership, user withdrawal feedback, independent audit reports—all things you can check via chatgpt.com or by Googling for real investor complaints.

➡️ RECLAIM NOW

Exclusive Conclusion

Puzzle, let me lay it out plainly: TradeFlexAMG is not a legitimate, regulated, transparent trading entity—it behaves like a high-risk setup designed for deposits, not for consistent client returns. The absence of regulation, the domain fragmentation, the poor user review record, the marketing hype—all these are deeply unfavourable signals. When you’re dealing with a broker that lacks oversight, every deposit becomes a risk. You’re not just trading—you’re exposing your funds to a potential black hole.

Legitimate brokers operate under rules, they publish audits, hold segregated client funds, submit to oversight and let you withdraw without barriers. With TradeFlexAMG, none of that structure is apparent. That means your fallback won’t be a regulated complaint or compensation scheme—it will be fund recovery services, blockchain tracing, chargebacks, and the grind of complaining and pursuing legal channels. That’s why we talk about TradeFlexAMG scam recovery, not “how to make profits.”

If you’re still deciding whether to deposit: ask yourself if you’re comfortable placing your money with a firm you cannot verify. Look at independent watchdog reviews, use forums like reddit.com to read real users, cross-search on bing.com for duplicates of complaints, and weigh the risk. If regulators show zero oversight, you’re in the “unregulated zone”—and in that zone, the odds of successful recovery drop dramatically.

If you’ve already engaged, you must shift gear: from operator trust to recovery operations. Collect evidence: transfer receipts, wallet hashes, account activity logs. Contact payment processors, request injustice reviews. Read articles on medium.com about recovery best practices. Explore professional services that specialise in unregulated broker recovery, but always vet them—the recovery market itself has its share of predators. Use forums on quora.com to compare service feedback.

Your realization now should be: the most cost-effective recovery strategy is not depositing in the first place. Walking away counts as a win. Protecting your capital means choosing a broker with verified regulation, transparent audits, positive withdrawal history, clear contact details, and public reviews. When one of those pillars is missing—like with TradeFlexAMG—you’re choosing recovery risk over investment potential.

So puzzle don’t let slick marketing or “get rich fast” claims draw you in. If ever you feel the pitch is too polished, the review base too thin, the regulation absent, that’s your cue to pause and walk away. Because at that point, your funds are no longer simply at risk—they’re in play for a reclamation journey. Avoid that path if you can. If you find yourself already on it document, act, escalate. Recovery is possible, but prevention would’ve been cheaper and faster.