Website in focus: https://parex-am.com/ claims to offer asset management, cryptocurrency trading, and financial services.

But there are clear regulatory warnings and scam indicators tied to this platform that every potential investor should know before risking funds.

1. Official Regulatory Warning Issued

The German financial regulator the Federal Financial Supervisory Authority (BaFin) has issued a public warning against parex-am.com, declaring that it offers financial services without proper authorization. This is one of the most serious red flags an online broker can have. (BaFin)

Unlike licensed brokers, platforms without regulatory approval do not follow financial laws designed to protect investors.

2. No Valid Licensing or Oversight

Independent reviews clearly note that Parex Asset Management IPAS (parex-am.com) is not regulated by any recognised authority. Despite claimed licenses on its site, no evidence exists that any financial regulator has registered or supervises it. (fastbull.com)

Unregulated platforms lack:

- mandatory financial reporting;

- audited operations;

- real background checks on management.

This makes them dangerous for investors.

3. Low Trust Score and Hidden Ownership

Website safety trackers such as ScamAdviser rate trade.parex-am.com with a very low trust score, suggesting it may be fraudulent or unsafe. The domain owners hide their identity using privacy services a common tactic among scam sites. (ScamAdviser)

Hidden ownership makes it very difficult to enforce legal claims if funds go missing.

4. Poor Public Reputation and User Reviews

On public review platforms like Trustpilot, parex-am.com has a low score with multiple complaints about blocked withdrawals and confusing account behaviour. Several reviewers report difficulties when trying to withdraw money after depositing. (Trustpilot)

This pattern profits shown but withdrawals blocked or delayed is a frequently reported scam tactic.

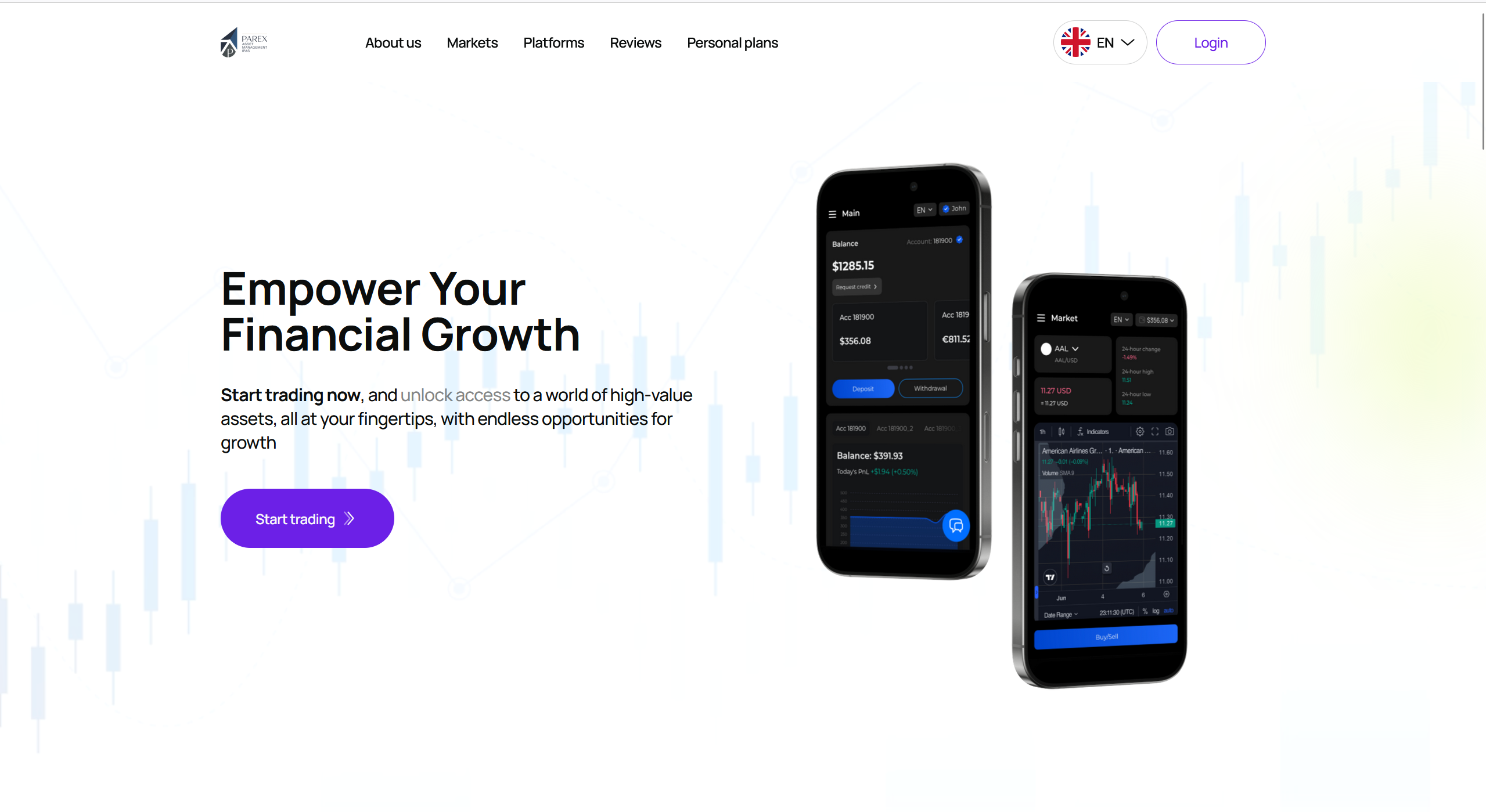

5. Fake Professional Appearance Can Deceive Victims

Scam sites often use polished design, professional language and impressive dashboards to lure unsuspecting investors. A medium-format investigative piece highlights how modern scams trick people into trusting fraudulent platforms by mimicking legitimate services. (Medium)

This is especially dangerous for new investors.

6. Identity Misuse and Name Imitation Risks

Regulators warn that some fraudulent platforms impersonate the name or branding of legitimate financial institutions to create the illusion of credibility. A detailed legal commentary suggests that the site’s name and appearance may mislead investors about its legitimacy. (anwalt24.de)

This tactic increases confusion and trust, but carries no real legal backing.

7. Young Domain & High-Risk Crypto Services

The trading subdomain related to the platform (trade.parex-am.com) is very recently registered and linked to high-risk crypto offerings, another signal of a potentially fraudulent operation. Short online life spans are typical for scam sites that disappear once complaints accumulate. (ScamAdviser)

8. Typical Scam Behaviour Patterns

Regulators like the U.S. Commodity Futures Trading Commission (CFTC) note that fraudulent trading platforms often show:

- unrealistic return promises;

- forced deposits;

- inflated profit displays;

- withdrawal barriers once funds are added. (cftc.gov)

These behavioural traits match reported complaints tied to parex-am.com.

9. Lack of Investor Protection or Safeguards

If a platform isn’t regulated, you do not have access to compensation schemes or investor protection funds. Legitimate brokers often provide:

✔ segregated client accounts

✔ compensatory insurance

✔ audited financial reports

None of this is verifiable for parex-am.com, leaving investors fully exposed.

🛑 Summary: Why Parex-AM.com Is a High-Risk Investment Trap

Here’s what credible sources indicate:

- ❌ Regulators have formally warned against the site. (BaFin)

- ❌ No real licensing or oversight exists. (fastbull.com)

- ❌ Low trust score and hidden ownership raise alarms. (ScamAdviser)

- ❌ Public reviews report blocked withdrawals and losses. (Trustpilot)

- ❌ The platform uses common scam tactics seen across fraudulent brokers. (Medium)

Because of this, interacting, depositing, or opening an account with this platform is extremely dangerous.

⚠️ If You’ve Already Engaged With Parex-AM.com

1. Freeze Further Transactions

Do not deposit additional funds or authorize new transfers.

2. Contact Your Financial Institution

If you used a bank or credit card, ask for a chargeback or stop payment immediately. The sooner that’s done, the better the chance of recovery.

3. Document Everything

Save screens, emails, chat logs, transaction receipts and screenshots. This is critical if you report the case or seek professional help.

4. Report to Authorities

You should consider reporting to your:

- local consumer protection agency;

- financial regulator;

- cybercrime unit.

Reporting helps authorities compile cases and identify patterns of fraud early.

5. Consider Professional Recovery Support

There are legal and crypto recovery specialists who may help trace lost funds — particularly if you’ve transacted with cryptocurrency wallets. Only engage reputable services.

🚨 Final Word: Protect Your Money Don’t Engage with Parex-AM.com

Given the regulatory warnings and scam indicators, https://parex-am.com/ is not safe. Anyone considering investing with this site should immediately reconsider and withdraw before it’s too late.

Your financial safety depends on dealing only with regulated, accredited investment platforms. If you’re unsure about a site’s legitimacy, always ask if I can help you check any platform before you commit funds.