When dealing with large, well-known banks such as QNB Türkiye, it’s easy to assume everything is safe and by the book—but that assumption can be your undoing. Behind the facade of corporate credibility lie real risks: onboarding errors, impersonation attacks, data-leak vulnerabilities, and financial traps that even big banks wrestle with.

Here are six aggressive reasons to reject blind trust and keep your guard sharp.

1. Big Name Zero Risk

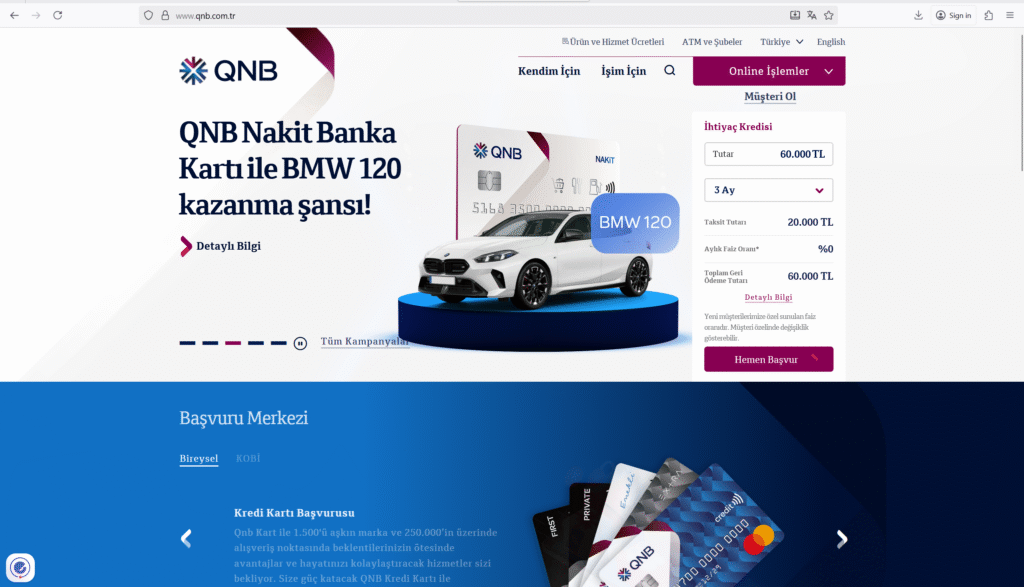

QNB Türkiye (formerly Finansbank) is a recognized bank with deep roots in Turkey’s financial ecosystem. (qnb.com.tr) Yet scale doesn’t eliminate vulnerability. The more prominent a bank becomes, the more it becomes a target—both for cyber-fraud and for customer-mistake exposure.

Assuming “they’ve got it all sorted” means you become prey rather than client.

2. Digital Onboarding & Remote Access Increase Exposure

Modern banking services at QNB include mobile & internet banking, cards, loans and payment services. (qnb.com.tr) But this convenience opens doors: remote identity verification, digital signatures, third-party data flow.

Every extra layer of “ease” is another interface where things can go wrong—mis-configuration, credential theft, or outsider access. Stay alert.

3. Banking Service Doesn’t Mean Crypto Safety

Many banks reposition themselves for crypto-friendly services. While QNB is a large, legitimate bank, if you are using it in conjunction with high-risk assets (crypto trading, third-party wallets, unverified lenders) you must still verify each link—not assume protection automatically.

Large banks have policies, but you are responsible for each step you take.

4. Even Banks Face Impersonation & Scam Channels

When you link your account with multiple services, payment gateways, wallet platforms or card systems, fraudsters exploit the overlap. You might receive a call or email claiming to be “QNB support” or “security department”asking for unusual transfers or credential confirmations.

Always authenticate from an independent official source before transferring funds or revealing sensitive information.

5. Withdrawal or Transfer Restrictions Can Cost You Time & Money

Banks often have strong deposit systems, yet customers sometimes experience hold-ups on large transfers, international transactions, or linked third-party services.

If you use your QNB account for complex financial flows cross-border funds, alternative assets, high-volume transfers est the exit path and don’t assume everything will be seamless.

6. Your Gut Instinct Must Trigger Action—not Delay

If you feel uneasy—an unsolicited contact from “bank compliance”, an unusual app push, a card transaction you didn’t make, or an unfamiliar digital platform linking your account—act fast. Delay gives fraud or error time to escalate.

Your first move should be documentation, freezing movement, and escalation. Don’t count on “they’ll fix it” later.

🔍 Final Words

Working with a recognized institution like QNB Türkiye is better than using no bank at all—but it’s not enough by itself. You must treat every transaction, every service link, every external platform as if your security depends on it—because it does.

The big bank won’t protect you from your own errors, nor fight for you if you follow a sketchy link or sign up for a third-party service with your bank account. Your vigilance is the final line of defence.

Proceed with clarity.

Question every unusual request.

Verify everything.

Escalate when needed.

Because when you relax—loss finds its way.

Stay smart. Stay alert.