Introduction

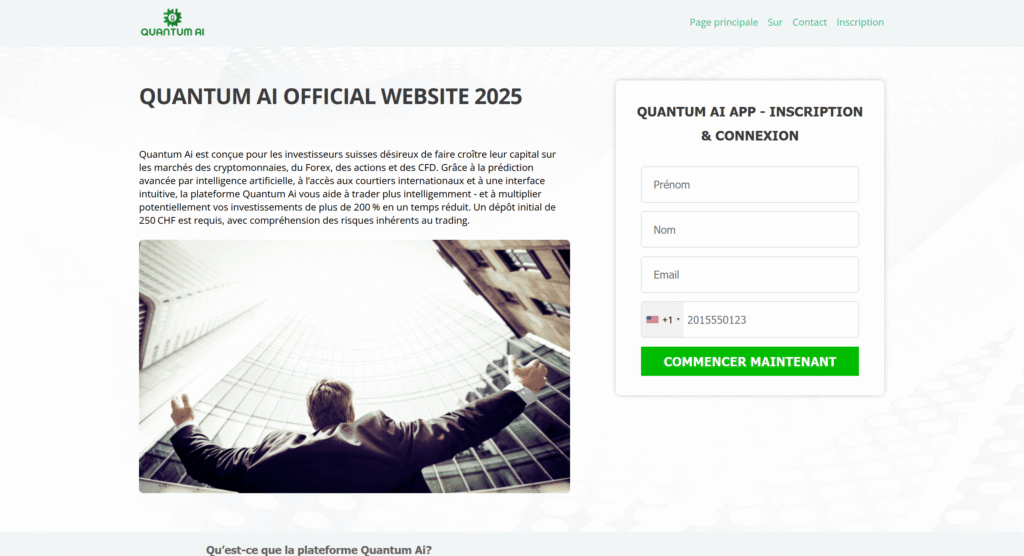

Quantum AI has become one of the most talked-about investment platforms lately promising high returns powered by AI, quantum computing, and sophisticated trading algorithms. Many versions of Quantum AI are being circulated globally, often under different domain names such as quantumai-ch . But beneath the hype lie serious concerns. In this article, I expose 7 alarming signs that QuantumAI-CH.com (or its variants) is likely a scam. You’ll see how regulators have warned, how deepfakes and false endorsements are used, how users complain, and how the structure is built to trap victims. By the end, you’ll know whether this is safe or a danger zone.

1. Multiple Regulatory Warnings Against “quantumai-ch” Brand

Before even looking at the specific domain QuantumAI-CH.com, the broader Quantum AI brand has already drawn multiple warnings from regulatory bodies:

- FCA (UK) warns that “Quantum AI” is not authorised or registered and may be promoting financial products without permission.

- Central Bank of Ireland issued warning that “Quantum AI” is not registered to provide virtual asset or investment services in Ireland, and that it uses deepfake videos, fake articles, and impersonation tactics.

- ASIC / Australia’s MoneySmart includes Quantum AI in its “investor alert list” as an unlicensed entity that may be offering investments illegally.

- SFC (Hong Kong) suspects Quantum AI used a false “news” site to disseminate misleading content about itself.

These widespread warnings against variants of “Quantum AI” suggest that any site operating under that name—especially variants like QuantumAI-CH.com—must be viewed with extreme suspicion. The brand’s strategy is to spawn multiple local domains, but the same warning patterns apply.

2. Use of Deepfake Celebrity Endorsements & Fake News Tactics

One of the hallmark tactics used in promoting “Quantum AI” schemes is impersonation through AI / deepfake technology:

- Fake videos purportedly showing Elon Musk endorsing Quantum AI have circulated. These videos use manipulated footage or dubbed audio to mislead viewers.

- False “news articles” appearing to be from legitimate outlets (e.g. BBC, 9 News) are used to lend credibility, often linking to Quantum AI sites.

- Which? (consumer org) warns that the Quantum AI scam impersonates celebrities and uses AI-generated content to falsely promote investment offers.

- The SFC pointed out that Quantum AI may have used a bogus news site to push misleading claims about itself.

These tactics are designed to build trust by association—to trick people into thinking “if Elon Musk supports it, it must be real.” But in truth, these are artificial constructions meant to deceive.

3. Trustpilot & User Reviews Reveal Withdrawal Failures

Looking specifically at QuantumAI-CH.com, its Trustpilot presence is minimal but revealing:

- There is 1 review on Trustpilot for “Quantumai Ch er says they had to involve “Rose Lane (GP)” to recover losses.

- Overall, within the broader “Quantum AI / quantum ai.io / variants” space, Trustpilot reviews are overwhelmingly negative, with repeated complaints of “frozen funds,” inability to withdraw, and broken promises.

The pattern is consistent: users deposit, see apparent “growth” on paper, then encounter obstacles when trying to cash out. These are classic withdrawal trap scenarios.

4. Brand Variants & Domain Proliferation Strategy

Quantum AI operates via many domain variants (quantumai.io, quantumai-ch.com, etc.). This proliferation allows the scam to:

- Evade domain takedowns / reputation damage on one domain by shifting to another

- Tailor local branding to appear as a local or Swiss-based version

- Prevent regulators from immediately shutting down all versions at once

Because of this fragmentation, it’s harder for users to pin down identity, ownership, license info, or consistent user experience. If you see a variant of “Quantum AI” with no verifiable history, that alone is a strong red flag.

5. Promises of Guaranteed Returns & Lack of Transparency

The marketing around Quantum AI is riddled with overly ambitious claims:

- Promises of consistent, high returns with little risk. No real trading system—especially one with AI + quantum computing—is capable of guaranteeing profits.

- Omitting or hiding key details: no clear disclosures of trading strategy, no audit reports, no transparent performance history. Reviews of quantum AI platforms indicate lack of transparency in how decisions are made.

- Use of buzzwords (“quantum computing,” “AI trading bot,” “supercharged returns”) without technical backup, often used to impress non-expert investor

These elements aim to hypnotize potential investors rather than offer real, verifiable investment infrastructure.

6. The Scam Lifecycle: Deposit → Blocked Withdrawal → Vanishing

From patterns observed in quantum AI variants, the lifecycle usually follows:

- User is lured via ads or deepfake endorsements

- They register, deposit funds—often via crypto or wire (harder to reverse)

- They may see simulated “profits” in dashboards

- When attempting withdrawal, they face excuses, “verification fees,” delays, or outright blocking

- The domain may go offline, change, or vanish, making reclamation extremely difficult

This is not hypothetical. Many users in reviews describe precisely this experience.

Once a domain is down, or the brand rebrands, many victims lose all access and recourse.

7. High Risk of Recovery Scams & Secondary Scams

As victims realize they may have been tricked, they become vulnerable to further exploitation:

- “Recovery agents” or “asset retrieval services” approach victims offering help—for fees. Many of these are themselves scams.

- The site or its affiliates might recommend a “trusted partner” to help recover funds, but that simply continues the cycle of fraud.

- Because the original operator is anonymous, the recovery “firm” presents itself as savior—but demands more deposits or data, then disappears.

This double-scam layering is a favored structure: first trap via investment, then trap again via “helping” you recover.

Conclusion

After reviewing the evidence, it is clear that Quantumai-ch.com is much more than just a flashy site promising effortless gainsit fits the blueprint of a high-risk, deeply deceptive scam operation. The widespread regulatory warnings against the “Quantum AI” brand, the use of deepfakes and impersonation, the withdrawal complaints, the domain proliferation, and the lack of transparency all combine into a dangerous package.

First, the regulatory red flags cannot be ignored. When authorities like the FCA, Central Bank of Ireland, ASIC, and Hong Kong’s SFC issue warnings about Quantum AI and label it unauthorized, that points to systemic dishonesty. These bodies don’t act lightly. Their warnings apply across versions of the Quantum AI brand, so any variant—QuantumAI-CH.com included—is tainted by suspicion.

Second, the deployment of AI deepfake endorsements and fake news tactics shows a high level of sophistication in deception. If you are persuaded by a video showing a celebrity endorsing the platform, realize that such content can be automated and faked. These are manipulative tools, not proof of legitimacy.

Third, user reviews confirm what one would expect after such marketing: deposits accepted, profits shown, withdrawal blocked. The few reviews for QuantumAI-CH reveal exactly that pattern. The broader Quantum AI ecosystem shows repeated stories of “frozen funds” and support disappearing.

Fourth, the strategy of domain variants underlines the fragility of accountability. One domain gets exposed or shut down, the operation continues under another name. This game of whack-a-mole makes legal and reputational accountability very hard for victims to enforce.

Fifth, promises of guaranteed returns and lack of transparency are classical signs of fraud. Real financial services openly disclose methodology, audits, risks, ownership, and performance. Quantum AI variants tend to hide or evade all that.

Sixth, the lifecycle pattern—from deposit to blocked withdrawal to disappearance—is what many victims experience. The platform may simulate profit, but once you try to extract it, the traps emerge. At that point, you may be pushed into further scams or never recover anything.

Seventh, recovery scams are the final dangerous twist. When people realize they’ve been scammed, they are desperate. Operators use that desperation by offering “help” for a fee, adding insult to injury. Many of these recovery firms are mirror scams built to siphon more funds.

If you or anyone you know is being drawn to QuantumAI-CH.com or any “Quantum AI” variant, here’s what you should do:

- Don’t deposit anything until the site can demonstrably prove transparent licensing, audited performance, verifiable leadership, and a consistent history of successful withdrawals by real users.

- Gather evidence: if you already deposited, keep all transaction records, screenshots, correspondence, and how “profits” were shown.

- Report the site and your experience to regulatory bodies in your jurisdiction and globally (FCA, SEC, ASIC, etc.).

- Avoid recovery agents unless they are extremely credible and verified by multiple independent sources.

- Warn others by sharing this analysis, posting in forums and scam-alert communities, so fewer people fall in.

- Use only regulated platforms: verify if a broker is listed in regulators’ registers before trusting them.